Countries adopt different income tax systems to ensure income redistribution among households. Of the three possible taxation alternatives – regressive, flat and progressive – the majority of countries apply the latter. Why progressive taxation? When developing economic policies, countries are faced with choosing one of two approaches when it comes to taxation system implementation: social justice or market efficiency. Evidently, modern welfare states choose social justice. What this ideology represents is that high-income earners have to pay a larger percentage of their income than those with low or no income at all. This is one of the main components in the fight against income inequality and the answer to the question: why progressive taxation?

The main differences among these three taxation systems are the following:

- In regressive taxation systems, the tax rate decreases with the increase of a taxpayer’s income, placing more burden on low-income earners. An example of this type of taxation is the value-added tax (VAT). By buying the same product, people with different incomes pay the same price which, however, counts for a higher percentage for low-income earners than for high-income earners. This means that the tax burden, again, is greater for those with low income. Hence, regressive income tax works by principles that facilitate income inequality, even though it does aid in reducing the shadow economy.

- In flat taxation systems, the tax rate is the same for all, no matter the income. This system corresponds with the principles of market efficiency because everyone pays the same share of their income no matter the circumstances. However, many experts consider this a step toward facilitating income inequality. In terms of ensuring well-being, it’s clear that the same share of income has different meanings for those with low and high incomes.

- In progressive taxation systems the tax rate increases based on income increase: those with higher income pay a larger share of their income and the opposite. This taxation system is considered the most effective in terms of social justice. The progressive tax creates more opportunities for income redistribution, despite hindering market efficiency: tax increase based on income increase restricts economic activity and quite often, in equal conditions fosters the growth of shadow economy.

The majority of countries implement the progressive taxation system as they consider social justice a first-priority issue. However, to avoid any negative consequence, a systematic approach is necessary for implementing progressive income tax and, simultaneously, creating other mechanisms that would foster economic activity. No less important is having the right rationale for progressive tax brackets. The French example is well-known: In 2013, French President Francois Hollande proposed and passed a decision which required those with an income higher than 1 million euros to pay 75 percent income tax. This decision was met with strong opposition by high-income earners. Actor Gérard Depardieu even renounced his French citizenship[2] because of this. Due to public pressure, this decision was retracted after a short period of time and the minimum threshold for tax rates was decreased to its former 50 percent. In terms of setting optimal rates, this was an exemplary case.

However, even in cases of 50, 40 or 30 percent tax rates, there is still a danger of a shadow economy emerging. To prevent this from happening it is necessary to propose certain benefits and/or social guarantees to tax-payers in return for the money they have paid in taxes. In these terms, it’s interesting to look at the approach different countries adopt, including market socialism of Scandinavian countries and liberal market economy of the United States: two different approaches with high and low tax burdens.

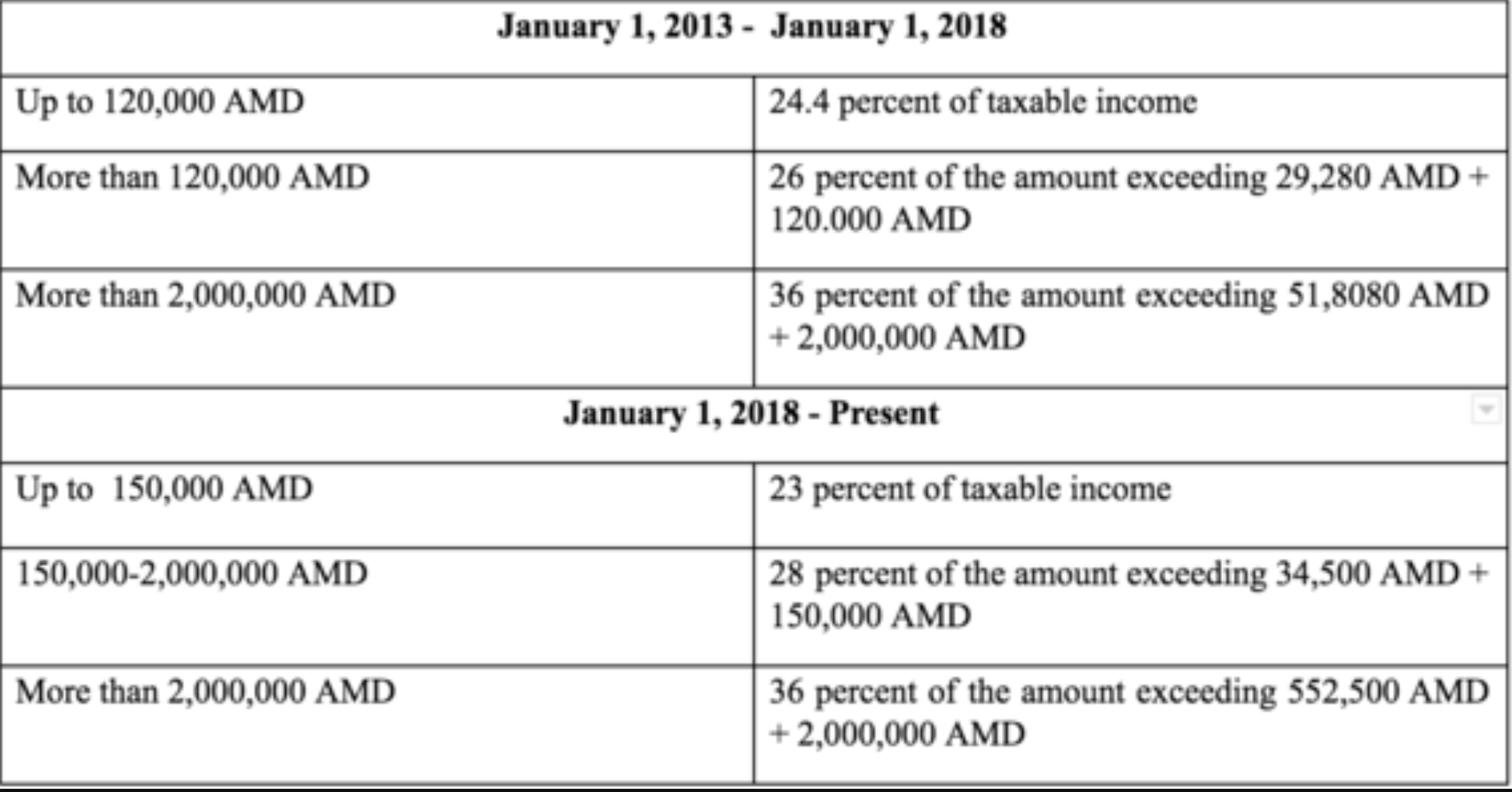

Like many other countries, Armenia has applied the progressive taxation system as well, a system based on income redistribution principles when there is income inequality. Data from the Statistical Committee of the Republic of Armenia also indicates the existence of a polarized income structure. Since 2017, the nominal cash flow income per household was 10,209 AMD for the poorest 10 percent of the population, and 172,413 AMD for the richest 10 percent.[3] According to officially registered incomes, those with the greatest income receive almost 17 times more than those with the lowest income in the country. These numbers presume that there is an income redistribution problem from the wealthy to the poor. The current taxation system works to alleviate the current wealth distribution problem, and taxes are collected through the following brackets and rates:

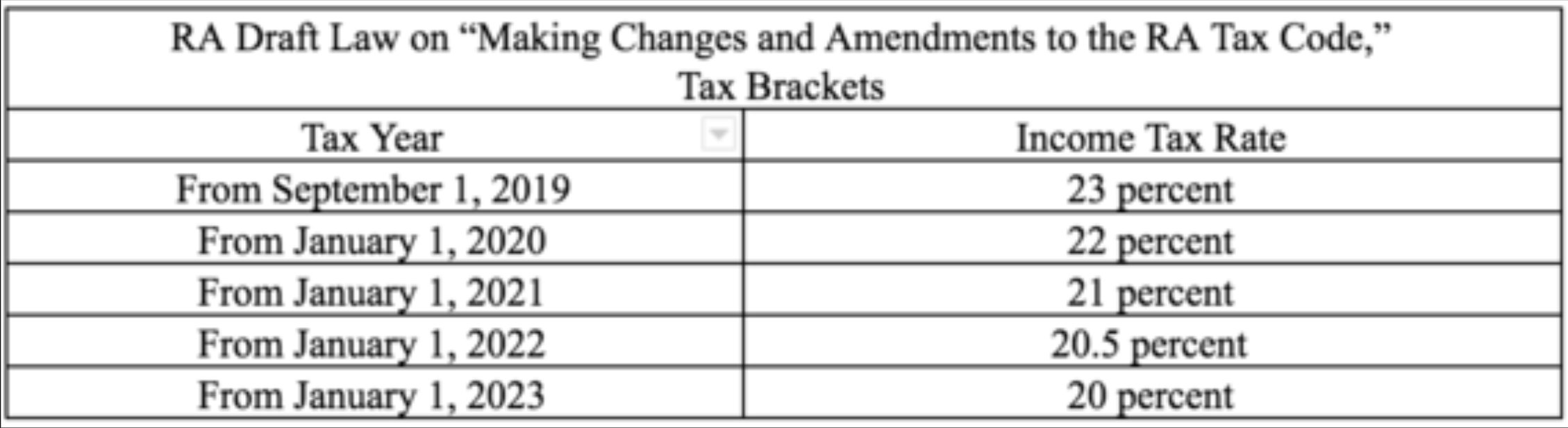

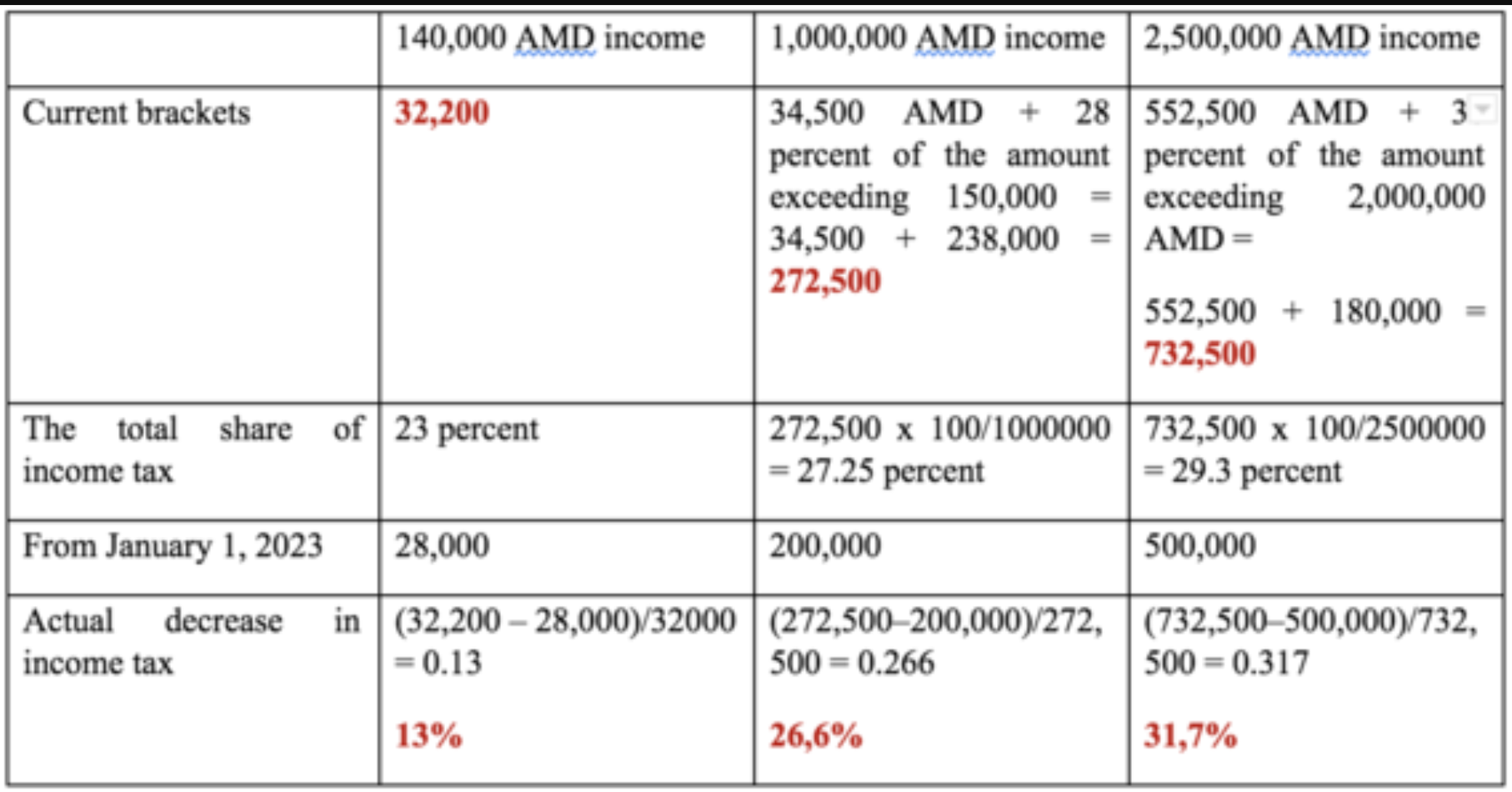

By transitioning to a flat taxation system, percentage-wise, the tax burden will significantly decrease for high-income earners, decreasing almost by 30 percent. In terms of absolute numbers, we can conclude that savings for low-income earners will be maximum 5,000 AMD, and for those with an income higher than 2,000,000 AMD savings can start from 150,000 AMD.

In general, this system will supposedly solve the issue of shadow income and help increase economic efficiency. However, experts have different opinions about this. Research has shown that cutting tax rates is not an efficient tool for decreasing shadow economy if a country is institutionally underdeveloped. In order to bring the taxpayer out of the shadow economy, it is necessary to create additional motives to make paying taxes more beneficial and attractive. A classic example is Sweden where the taxpayer relies on social guarantees and protection.

Hence, in order to have an efficient flat income taxation system, systemic solutions are necessary, firstly, to ensure efficient tax redistribution. If a taxpayer does not receive any protection or services that would improve his/her well being in return for the taxes he/she pays, then that taxpayer will not want to come out of the shadow willingly. It’s no coincidence that taxpayers in Scandinavian countries are willing to pay a large portion of their income, while post-Soviet countries view paying taxes as an obligation that does not require any demand. In this case, without systemic solutions, a flat income taxation system will only heighten income polarization.