The distribution of wealth among nations and within societies has always been a priority issue for policymakers. National governments try to implement popular public policy, i.e. the policy that corresponds to people’s perceptions of justice, as they are considered to judge the policy accordingly and then decide whether to abide by it or not. The popularity of governments (the measure that determines their reelection) and the feasibility of their policies, to a great extent, depend on positive feedback from the crowd. When a government is unpopular, citizens start to form a more active civil society to influence the decision-making process, potentially to the point of working to change who is in power. Since Armenia already achieved a non-violent revolution, one of the drivers for which was a desire for improved socioeconomic conditions, it is time to see what is changing in distributive justice in Armenia and whether public perceptions are reflected in these changes.

Starting from January 2020, the social security and tax system in Armenia underwent changes that are expected to mitigate income inequality and improve living standards among vulnerable social groups. On November 19, 2019, the Law on the Minimum Monthly Wage was amended – increasing the minimum monthly wage in Armenia to 68,000 AMD (~$135 USD) from 55,000 AMD (~$110 USD). The income tax system was also remodeled from a progressive model to a flat income tax rate, charging the same percentage to all citizens and eliminating the different tax brackets. The Ministry of Labor and Social Affairs declared that all social benefits will gradually be increased. Those are the main changes in distributive policies initiated so far by the post-revolutionary government. Let’s compare the previous distributive policies with the current ones and then look into the available sources of public opinion on the policies.

Tax System, Social Security and Minimum Wage in Armenia – Before and After January 2020

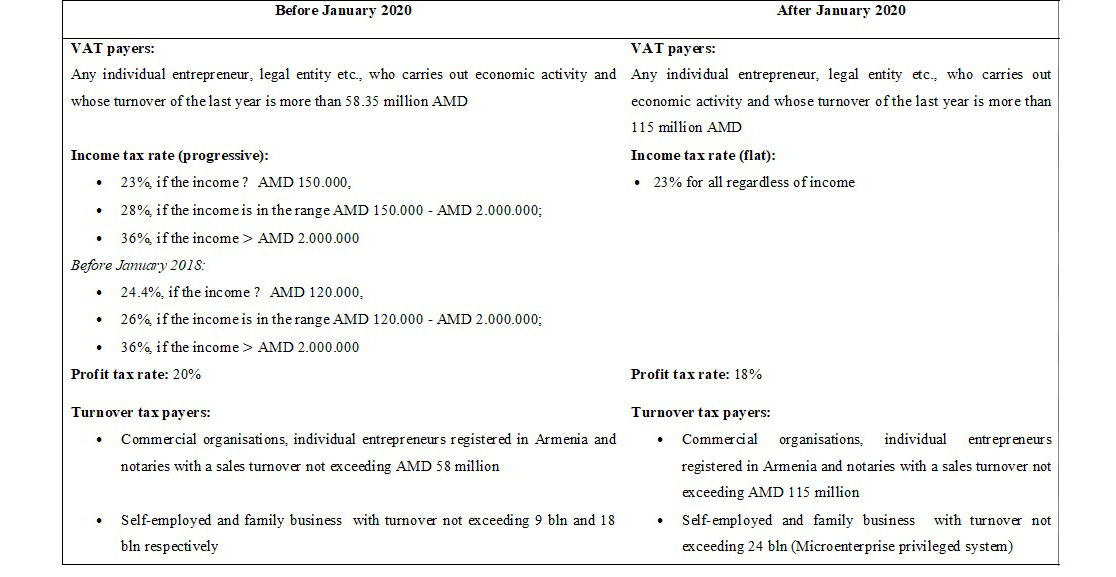

The four main changes that have been made to the tax system are the following (see Table 1):

Table 1. Tax Policy in Armenia Before and After 2020

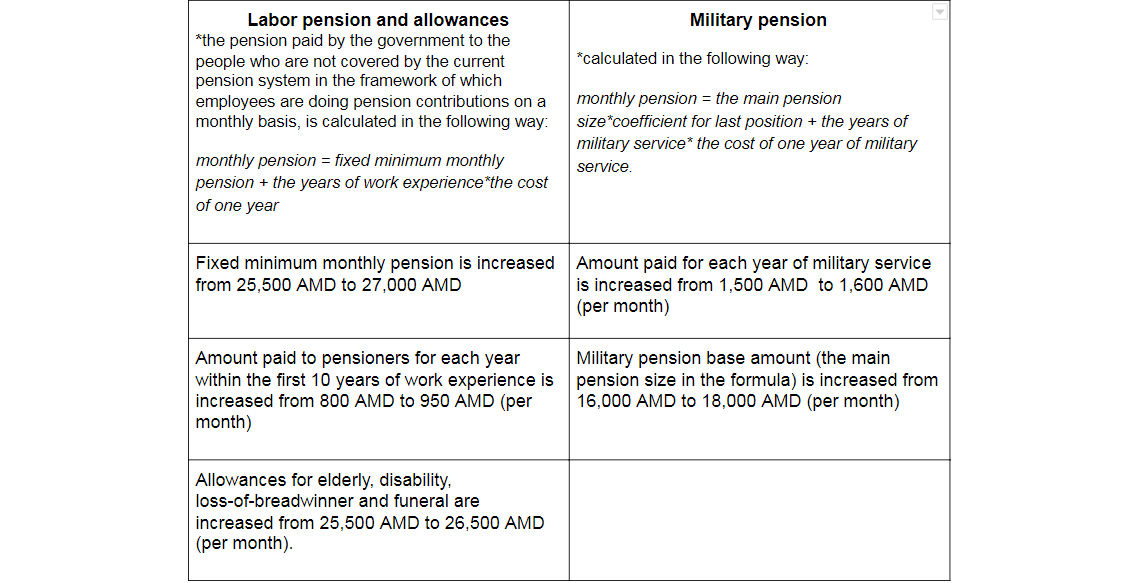

Social policy is regulated mainly by the laws describing the main pensions and allowances that are paid by the government to vulnerable groups:

- Pensions: labor pensions and military pensions

- Allowances (family, social, emergency, childbirth, maternity, temporary disability, old-age, long-term disability, loss-of-breadwinner, funeral)

The only missing social payment is the unemployment benefit, which was abandoned in 2014. Instead, that budget was reportedly directed toward employment promotion programs (e.g. career fests, etc.).

Starting January 2020, the Ministry of Labor and Social Affairs increased all pensions by an average of 10%. In 2019, the government introduced a fixed minimum monthly labor pension of 25,500 AMD (replacing the previous average of 17,500 AMD). The rest of the main reforms take effect in 2020. In the table below you can see the preliminary changes to the calculations of pensions and allowances.

A draft has also been prepared for a more inclusive Law on the Protection of the Rights of Persons with Disabilities and their Social Inclusion, an issue that has been on Parliament’s agenda for the past 3 years.

For many years, the minimum monthly wage did not cover the minimum consumer basket of an individual, i.e. it was not enough for the survival of one person.

Table 2. Minimum Monthly Wage and Minimum Consumer Basket in Armenia, 2013-2019

Sources: https://www.armstat.am/file/doc/99493608.pdf, https://www.armstat.am/file/doc/99516748.pdf; https://www.armstat.am/file/article/sv_12_15a_6200.pdf; https://www.armstat.am/file/article/sv_12_16a_6200.pdf; https://www.armstat.am/file/article/sv_12_17a_6200.pdf; https://www.armstat.am/file/article/sv_12_18a_6200.pdf

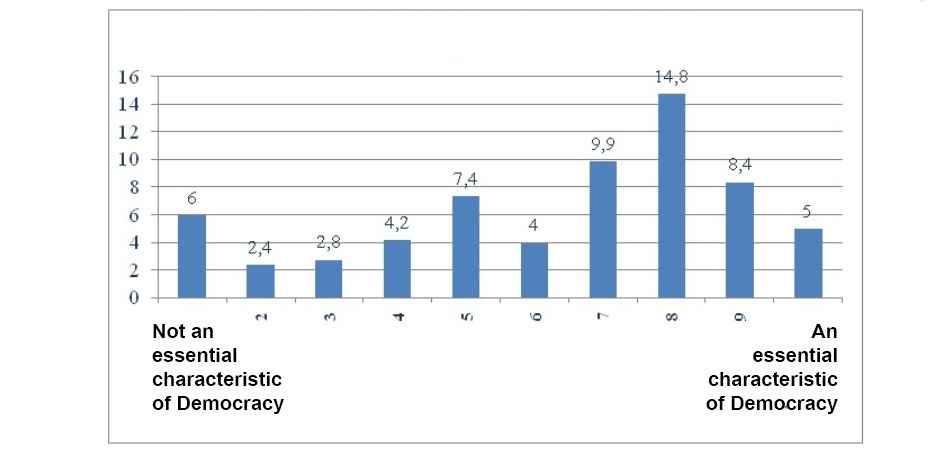

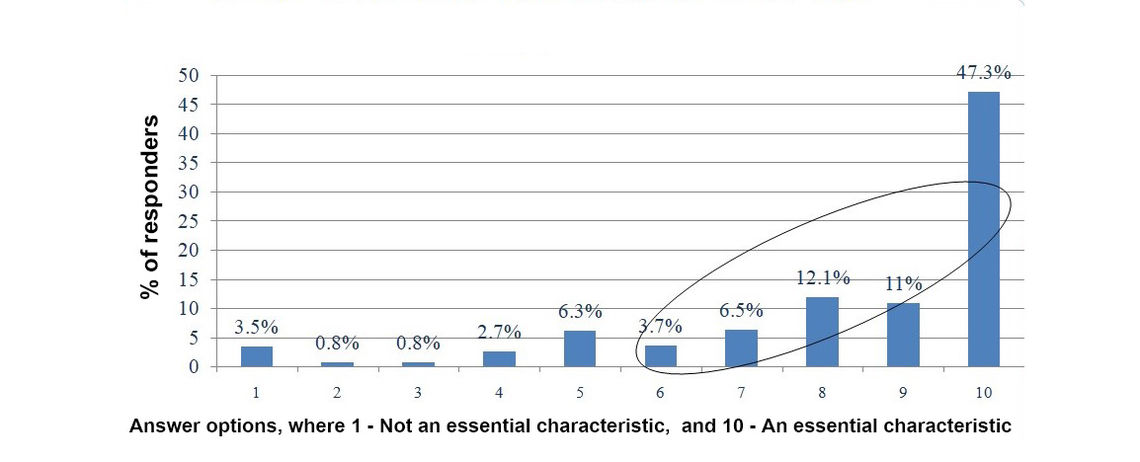

Chart 1: Democracy and Taxation of the Rich

Is it a characteristic of democracy – governments tax the rich and subsidize the poor?

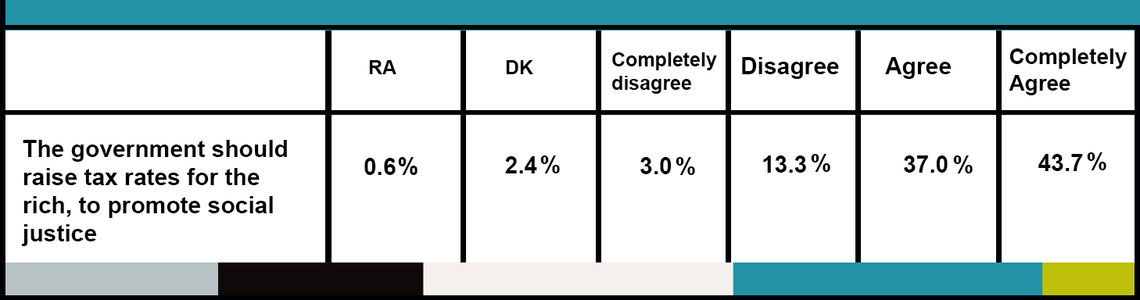

In 2013, the CRRC survey findings showed that household respondents still favored progressive taxation but with lower tax rates. At the time, the income tax rates were 24.4%, 26% and 36%. Forty-eight percent of business taxpayers named a decrease in the tax rates as the top priority, while 46% of households identified it as their second priority after a decrease in the number of taxes. 80.7% of households (See Table 3) and 66.3% of businesses indicated that the government should raise tax rates for the wealthy to promote social justice in society.

Table 3: Households’ Views on Taxation

In terms of the primary function of the tax authority, business taxpayers placed taxation of businesses in accordance with their capacity to pay as third-most important. Among households, the ranking was almost the same.

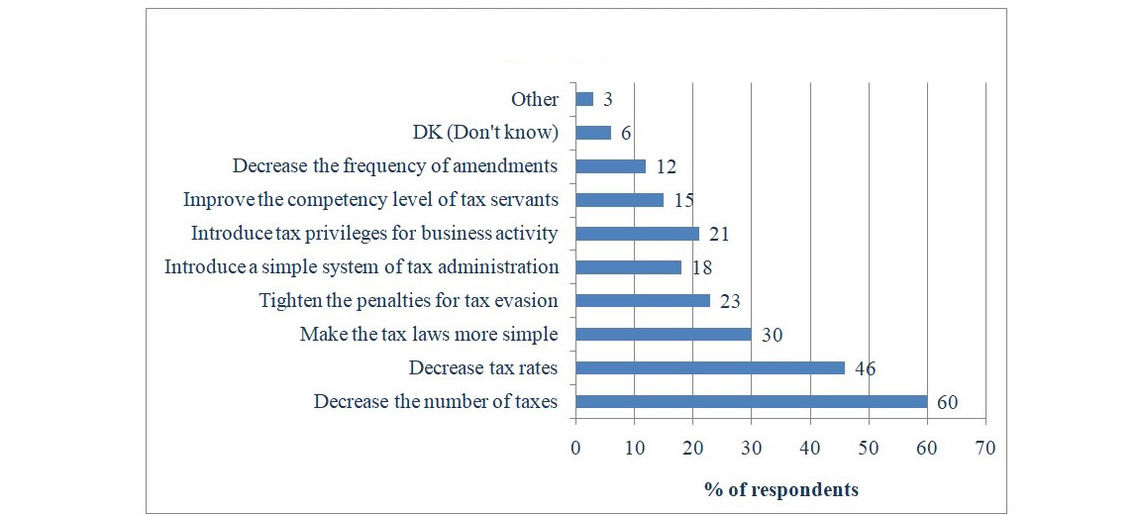

According to the most popular answers among all the respondents, the primary actions in tax law enforcement that they would undertake if they were engaged in a state agency would be decreasing the number of taxes and decreasing tax rates (See Chart 2).

Chart 2: Three Primary Actions of the Tax Authority

“Income should be made more equal” vs”We need larger income differences as incentive for individual effort”

If you were on a decision-maker in a state agency, which would be your three primary actions?

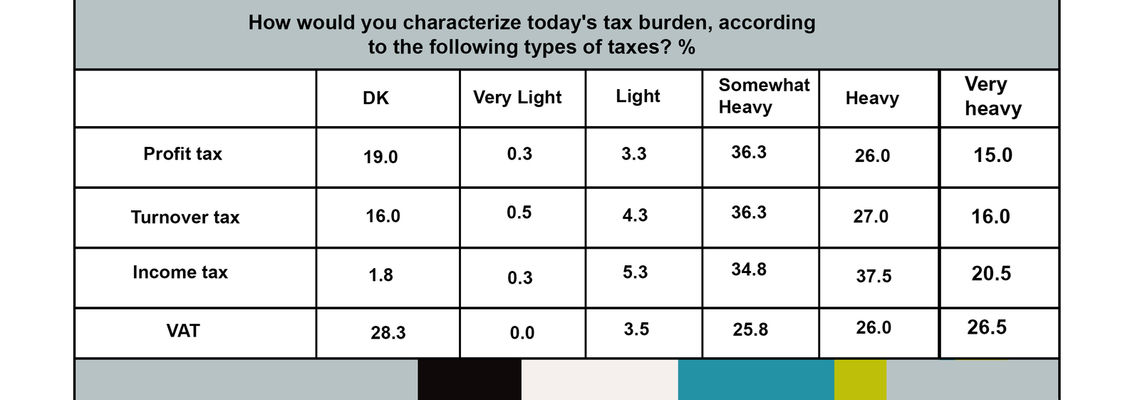

Table 4: Perception of Tax Burden

In 2016, according to the European Business Association survey findings, businesses still considered taxes to be heavy for them; over 40% of the respondents, who were company representatives, perceived taxes as too heavy of a burden for MSMEs. The respondents also reported that businesses were not involved in the development of the new tax code and that, consequently, their interests were not represented. As a result, in their opinion, the increase in income tax would encourage the expansion of the shadow economy.

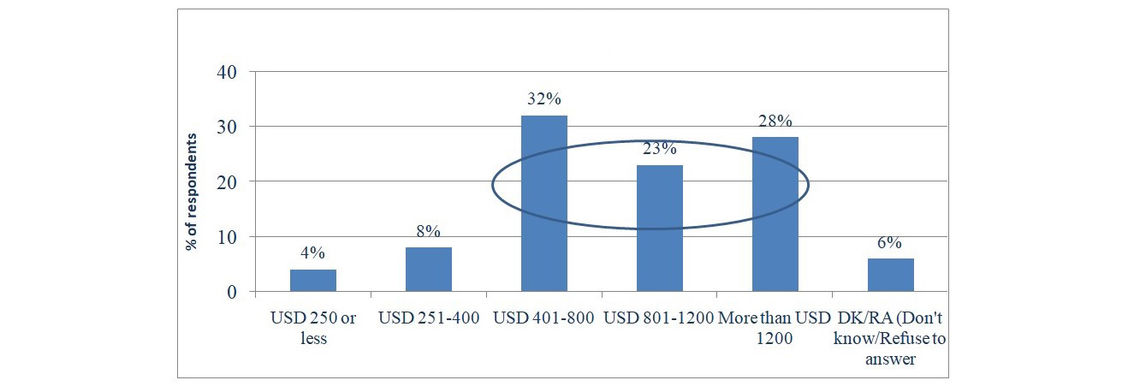

In 2017, only 4% of the respondents of the Caucasus Barometer nationwide survey believed that $250 USD per month was adequate for a normal life (see Chart 3). The oval in Chart 3 shows that the majority of respondents, 83%, needed much more than $250 USD. At the time, the minimum wage was set at $113 USD. In the previous 2015 survey, the indicators were almost the same.

Chart 3: Perceptions of Required Minimum Monthly Income

What is the minimum monthly income for a normal life?

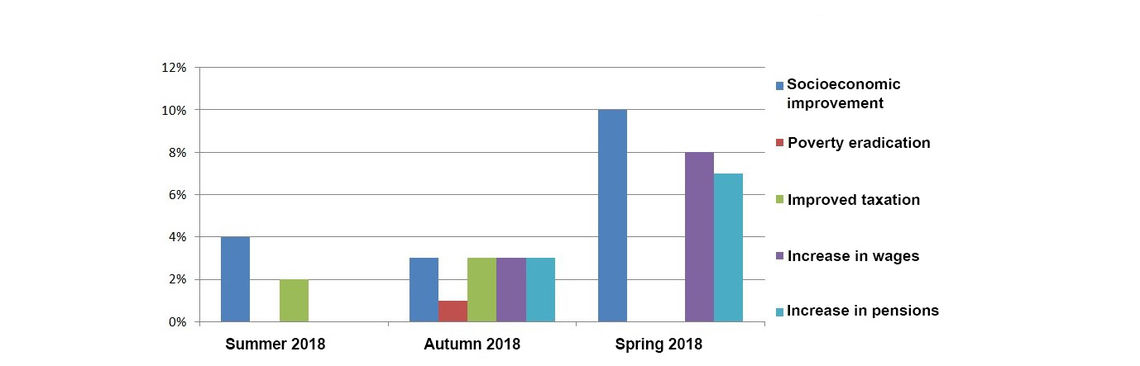

Chart 4: The Biggest Successes of the New Government in 2018-2019

What do you think are the biggest successes of the new government?

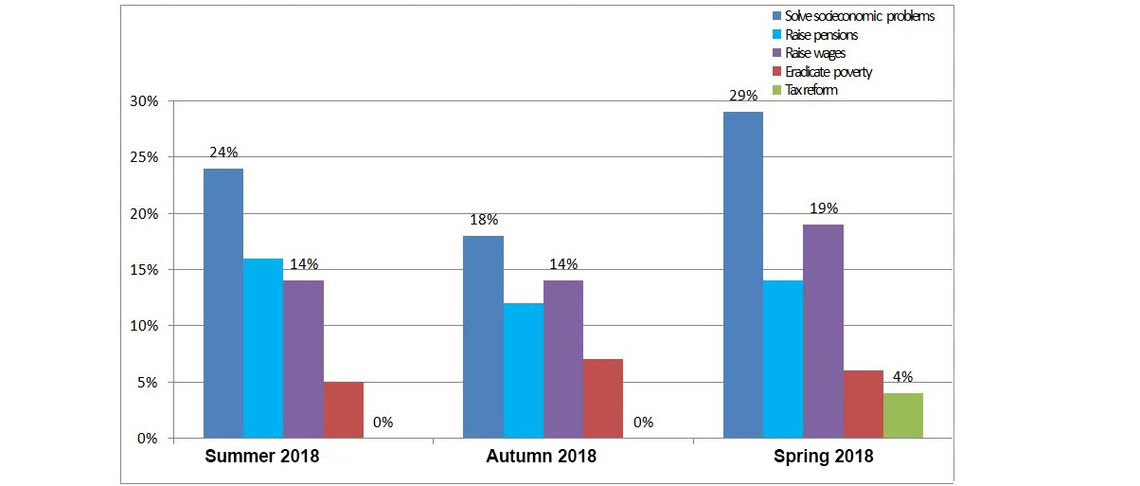

When asked about the “things that the government must achieve in 6 months” (see Chart 5), both in 2018 and 2019, respondents mentioned solving socioeconomic problems, raising pensions and wages, and eradicating/reducing poverty. Solving socioeconomic problems consistently ranked highest. Only in autumn 2019 did the percentage of respondents who named rising wages as one of the things to be solved in 6 months increase by 5%. Not surprisingly, in autumn 2019, the respondents mentioned tax reform for the first time. By that time the news about the upcoming tax reform was covered in the media.

Chart 5: Things That the Government Should Solve in Six Months, 2018-2019

In your opinion, what are three things you believe the Pashinyan government must achieve in the next six months? (all mentions are shown in this chart).

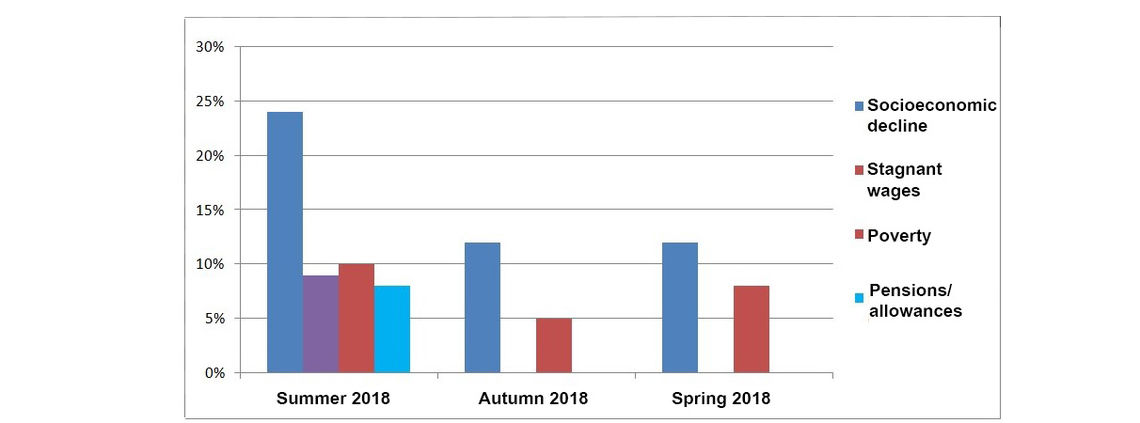

Socioeconomic problems also consistently ranked highest as an answer to what the main problems are that Armenia is facing. In regard to low pensions/allowances, there was no change throughout the year. The percentage of those who considered poverty one of the main problems increased drastically in spring 2019, by 8%, and then decreased in autumn by the same percentage. The percentage of those mentioning low salaries as one of the main problems increased slightly in 2019.

Chart 6: The Main Problems Armenia is Facing, 2018-2019

What are the main probelms Armenia is currently facing?

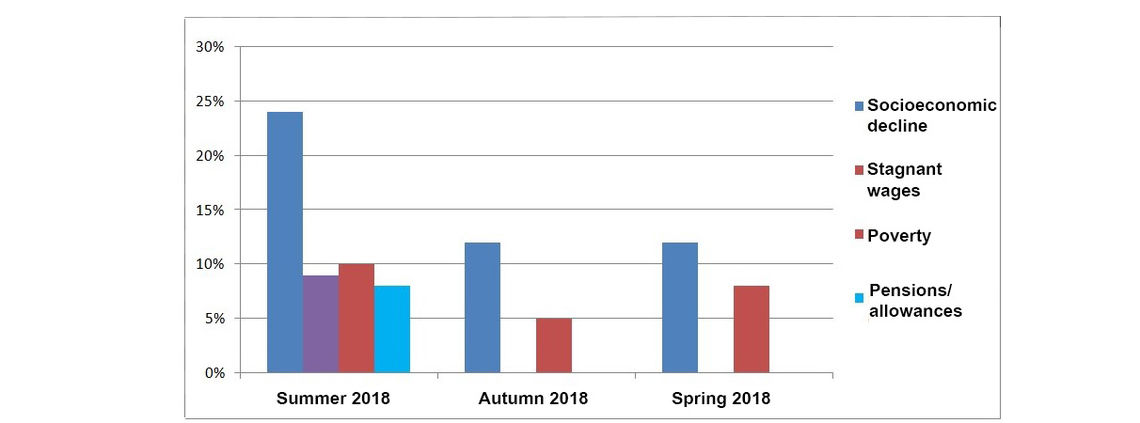

The fourth question is about major concerns about Armenia’s future (see Chart 7). Among the fears related to distributive justice, only socioeconomic decline and poverty were mentioned by the respondents in all three polls. Stagnant wages and pensions/allowances were mentioned only once – in summer 2018. The percentage of those who considered poverty one of the main fears was cut in half in autumn 2018 but then increased again in 2019.

Chart 7. Three Things that Armenians are Most Worried About, 2018-2019

Thinking about the current situation and the future of the country, what are the three things you are most worried about?

Apart from these four questions, additional ones were included in the last poll: “What forms of mistreatment or injustice did you or your relative experience?”, “What is the most important accomplishment of the current National Assembly?” and “What specific issue should be the top priority for the National Assembly to address?” It turns out that 8% of those reporting injustice or mistreatment since independence experienced it in the sphere of social services. Among the accomplishments of the National Assembly, the respondents listed increased salaries and increased pensions. Among the top distributive justice priorities were improving social conditions (10%), increasing salaries (7%), increasing pensions (6%) and reducing taxes (6%).

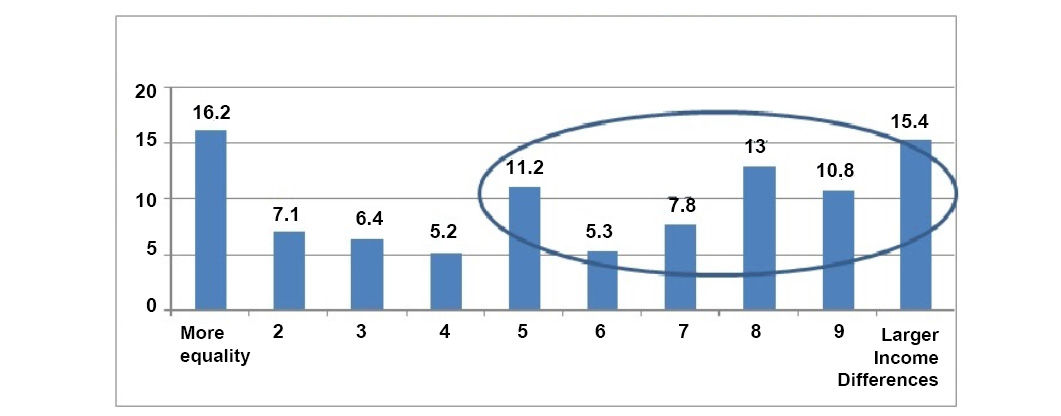

The WVS findings in 2011 revealed some patterns in the respondents’ perception of their government, which helped to understand people’s expectations from the government in public policy. The oval in

Chart 8 shows the percentage of respondents who either agreed to some extent that unemployment benefits are important or essential for democracy. In total, 81% of respondents thought that publicly-funded unemployment insurance is important for democracy.

Chart 8: Democracy and Unemployment Benefit

Is it an “essential characteristic of democracy:” People receive state aid for unemployment?

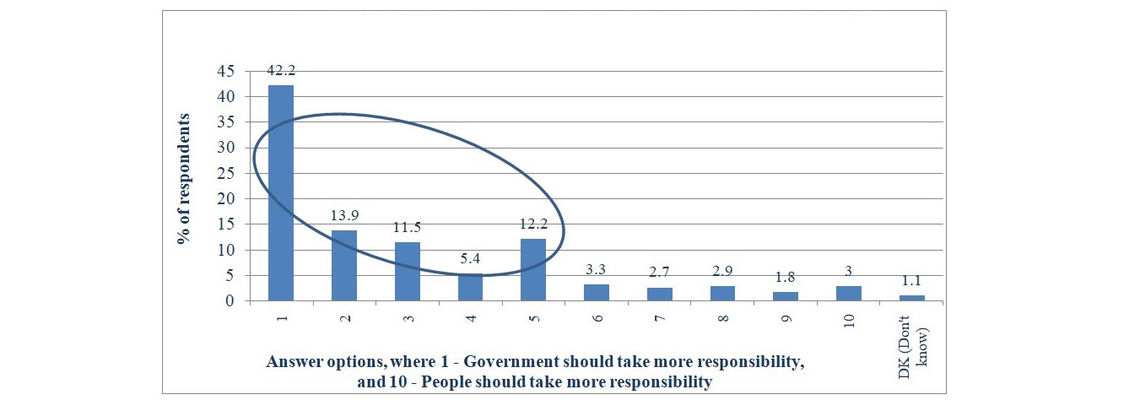

It should be mentioned that around 70% of respondents argued that the government is more responsible for the well-being of citizens, than they are themselves (see Chart 9).

Chart 9. Government’s vs. People’s Responsibility

“Government should take more responsibility to ensure that everyone is provided for” vs “People should take more responisbility to provide for themselves”

One of the findings of the report by the USAID Pension Reform project and the working group of the Ministry of Labor and Social Affairs in 2016 was that, despite the small size of the old-age pension and its small share in family income, it was considered to be an important source of stable household income.

In 2015, the results of interviews with 1,000 pensioners showed that their only dissatisfaction with the pension system was related to the amount they received. According to the interviewees, the pension was not enough to cover minimum subsistence needs (food, clothes, utilities).

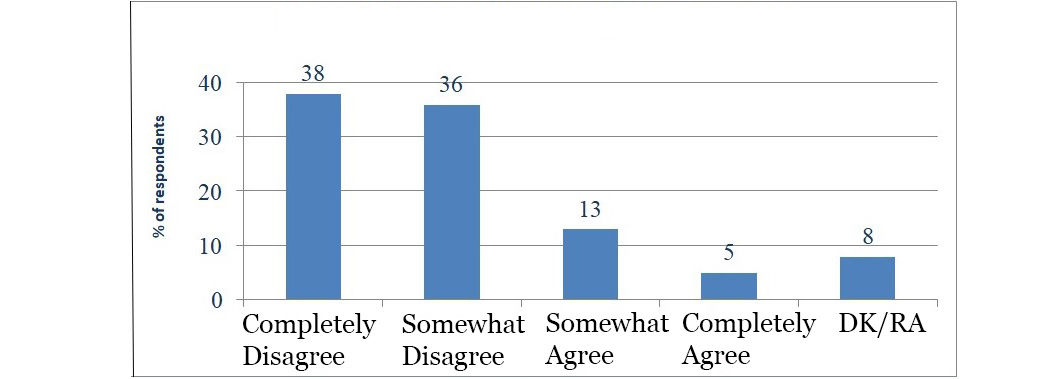

In the annual household nationwide survey about social economic and political attitudes conducted by the CRRC in 2017, unemployment and poverty were identified as the top two most important issues that the country was facing in 2017. Low wages and pensions were also mentioned by respondents. 74% of respondents disagreed that the Serzh Sargsyan-led government of the time treated people fairly (see Chart 10).

Chart 10. Government’s Attitude Towards its Citizens

Are people like yourself treated fairly by the government?

Public Perceptions and Public Policy in Armenia: Is There a Match?

The findings on tax perceptions before the Velvet Revolution reveal that households and businesses support progressive taxation, i.e. taxation according to capacity to pay, along with a decrease in tax rates. It seems that, after January 2018, the changes made to the Tax Code somehow reflected these opinions: the rate paid by the lowest income tax bracket was reduced, and that paid by the second income group was increased respectively, i.e. there was a reduction in the tax rate for the majority of taxpayers (65% of them belong to the first income group) and one more step was undertaken toward more progressive taxation. Now, the income tax rate has been decreased for those whose monthly earnings are over 150,000 AMD (~$300 USD) per month. The very essence of a flat tax system can hardly match just tax perceptions of those who earn less than 150,000 AMD; for them, nothing has changed, it is the higher two income groups — 150,000-2,000,000 AMD (34.7% of taxpayers) and over 2,000,000 AMD (0.3% of taxpayers) — that receive the relief. Interestingly, in the IRI survey findings, tax reforms were only mentioned in autumn 2019 among the things that the government should solve in 6 months, which means that the tax reform was already known and the choice of the answer was influenced by that.

The tax reforms undertaken by the pre-revolutionary and post-revolutionary governments in regards to VAT, turnover and profit tax seem to correspond to public expectations; small- and medium-sized businesses are given favorable conditions, with an opportunity to pay turnover tax instead of VAT. The turnover tax threshold was raised from 58 to 115 million AMD. A significant part of those SMEs who paid VAT last year (because their turnover exceeded 58 mln AMD) will now be paying turnover tax instead, which is far less than VAT, and a reduced profit tax. The government increased the threshold of taxable transactions for turnover taxpayers back in January 2016 (from 58.35 million AMD to 115 million AMD). Later on, when the post-revolutionary government came to power, it was reduced back to its original level because of issues related to hidden transactions. Now, it has been restored again to 115 million AMD. It can be concluded that there has been an attempt to consider public opinion while shaping the new policy. Moreover, private entrepreneurs and family businesses are now exposed to only one tax system.

Wages, as indicated by all the findings, have always been one of the greatest concerns among Armenians. The findings of the IRI poll in autumn 2019 are quite illustrative; they point to public approval of the government’s policy direction. The minimum monthly wage now covers minimum subsistence but still does not meet citizens’ expectations and beliefs about normal life. The findings of the two latest Caucasus Barometers (2015 and 2017) revealed that the vast majority of individuals believe they need more than $250 USD monthly to live a normal life, i.e. twice the minimum monthly wage. Even now, three years later, when both wages and living conditions have improved, the minimum wage (at ~$135 USD) is still far from that amount. Based on these findings, 83% believe that their life is not “normal.” Yet, government regulation is moving toward the direction of public opinion.

People perceive that the government should take responsibility for them. It is supposed to implement proactive social policy. Regarding the government caring for its citizens, the findings on the changes in public policy in the sphere of social security have shown that pre-revolutionary Armenia was on track to develop its social security system; the government has adopted and is going to adopt laws that envisage the whole range of benefits to almost all vulnerable groups. Furthermore, it has raised the amount of money allocated for social benefits. As the Law on Government Benefits prescribes care of insecure families and the Law on the Social Protection of the Disabled and the new draft guarantees their rights and access to normal public life, the overall policy could be considered as one in line with public expectations.

The lack of an unemployment benefit is one of the things that still causes public disapproval; people tend to perceive state aid to the unemployed as a typical feature of a democratic state.

Concerns related to low pensions is the second-most stable indicator mentioned by the respondents in the IRI polls, which emphasizes its importance for people. Thus, the current pension reform is most likely to reflect this demand.

Both pre-revolutionary and post-revolutionary governments, at least formally, have been trying to adjust distributive policies to match public expectations, which is natural for political elites who are interested in being popular. Nevertheless, as the findings show, even when the government is taking some steps to improve its policies, public approval does not follow immediately. In all these three domains (minimum monthly income, tax policy and the social security system), there are still many issues to solve. These spheres require constant work and improvement, and of course, resources. Undertaking reforms in distributive policies that would benefit people can bear financial risks. It is well-known that prudent financial policies are not always popular. Thus, whether the government should reflect public opinion in its policies or not – and, if yes, to what extent – is always an open-ended question.