The first part of this article series highlighted the important role our financial habits play in shaping Armenia’s future economic outcomes and development, both as investors and decision-makers in fund allocation.

This time the focus will be on the current structure of Armenia’s financial system. As capital supply improves — in other words, our savings — what areas need adjusting to serve as a more efficient financial transmission mechanism?

An educated guess would be that there’s room for improvement, which is undoubtedly true. But let’s first discuss the role of a well-functioning financial system, then establish Armenia’s current standing.

A robust and sophisticated financial system is crucial. The former relates to trust towards financial institutions, essentially ensuring our money and assets are safe. The sophistication aspect is no less important. It plays a vital role in financing different projects, businesses, ventures, and consumer-related activities. It is also important for public sector financing.

A one-sided, and heavily skewed financial system fails to provide diverse types of financing for timeline aspects, risk preferences, requirements, or types of capital offered. Different businesses have different risks, payback periods and financing needs. Additionally, investors have various risk tolerances and investment horizons. A well-functioning financial system does a much better job in matching these demands. In contrast, a financial system offering only one type of financing limits economic activity. A more sophisticated financial system would thus translate into more economic activity as it finances and launches diversified business projects.

Let’s look at Armenia’s financial system. Banks make up the largest portion of Armenia’s domestic financial system, accounting for approximately 79% of its total assets. Despite being well-regulated and devoid of bankruptcies for about 20 years, even throughout the 2009 Global Financial Crisis, this concentration might not be the most beneficial one. In the OECD (a group of predominantly developed countries), the proportion is significantly lower, around 40%.

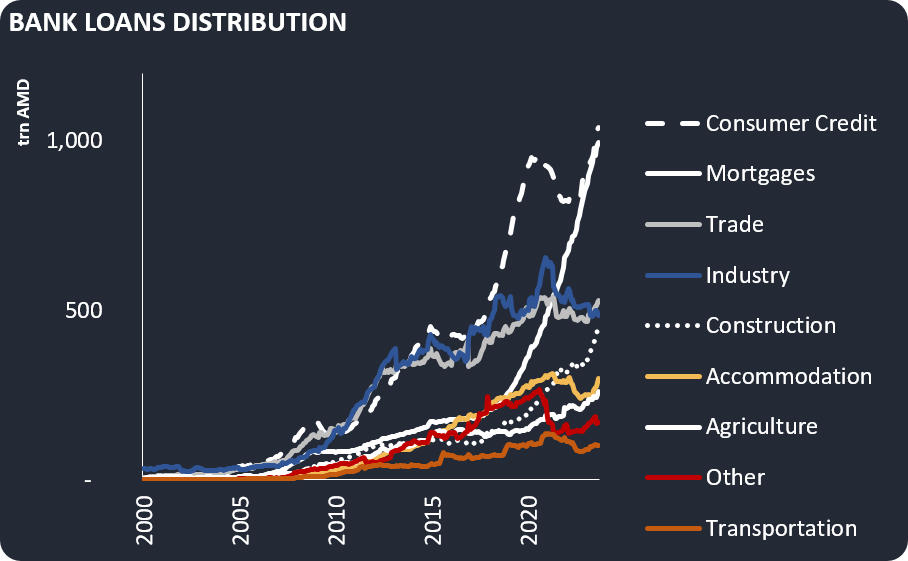

While the current diversification seems suboptimal, the structure of loan finance is also noteworthy. As the graphic shows, most finances are channeled into mortgage loans and consumer credit. From the perspective of enhancing productive capacities and capabilities, such as factories, sectors, and industries, there’s room for improvement. Banks, being private entities, assess their own risk-reward scenarios for various credit activities. These are business decisions, often made within strict legal frameworks and requirements. Policies such as mortgage deduction, implemented in the mid-2010s, have played a major role in incentivizing both credit and real estate activity. While this is understandable and is slowly moderating, from a future outcomes point of view, things could be better.

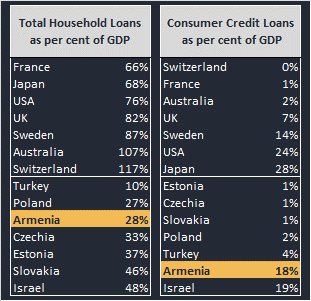

To benchmark Armenia with other countries and put the statistics in a more relative light, Armenia’s economy comes out as fairly reliant on household loans and consumer credit. Household loans, used for various purchases, constitute 28% of GDP. While this is lower than in developed countries, where high-priced real estate drives up mortgage loan values, it is comparable to Eastern European countries. In terms of consumer credit, a subset of household loans, the figure is 18%.

Consumer credit companies, another financial sub-sector, account for about 6% of Armenia’s financial assets. While they play a role in the economy, it’s difficult to argue that they meaningfully shape future outcomes positively. Much of their financing supports imports, thereby stimulating economic activity outside the domestic sphere.

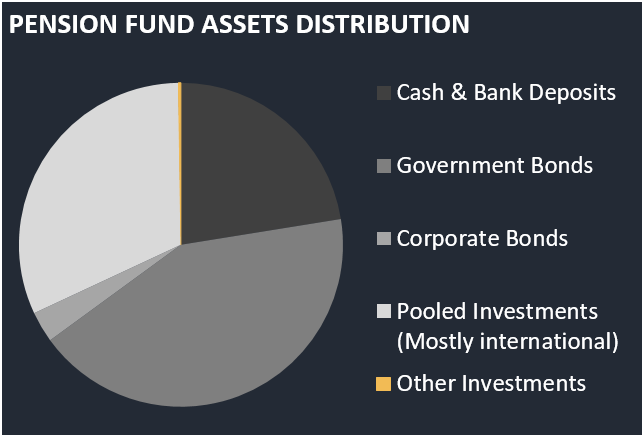

Pension fund assets are the fastest growing category of our financial system, accounting for 7% of the total. Armenia’s switch from the fully funded pension model (workers paying for retirees via the budget) to the “pay-as-you-go” model (individually tied contributions and payments) has led to this growth. The mandatory contributions by employees, matched by the Armenian state, have turned this sub-sector into a significant conduit for Armenia’s financial flows.

This pension fund model offers many benefits, including supporting capital markets development and improving capital allocation. The reform has been one of Armenia’s most effective policy changes in recent decades. However, looking at the numbers, its impact on future economic outcomes has been limited so far.

According to current statistics, most of our money is invested in either bank deposits (22%) or government bonds (43%). Regarding government bonds, while some funds may be directed towards needed infrastructure investments such as roads, schools, and utilities, most of this money is likely used to refinance previously obtained loans.

International best practice shows a more diversified allocation of pension funds into the private sector to support future growth and value addition. This is achieved through investments in corporate stocks, bonds, and various types of investment funds. However, in Armenia, constraints such as private company financial reporting and corporate governance must be considered. Still, a less diversified allocation isn’t optimal.

On a more positive note, some pension funds have recently been allocated to buy equity in a local telecom services provider, committing such funds to the local 5G network capacity build-out. Technology competitiveness is crucial for Armenia. While the allocated funds are quite small, hopefully, this signifies a shift towards supporting private business value addition, as is generally the case elsewhere.

Insurance company assets make up around 1% of our financial system, while investment companies represent approximately 2%. This is given the limited activity on domestic capital markets. These companies’ assets are primarily allocated towards deposits, government bonds, or international securities.

Capital Markets, a significant financial subsector represented in Armenia by the Armenian Stock Exchange (AMX), accounts for another 6%. There has been some encouraging progress in this sector recently. Over the past year, several policy papers and initiatives have been introduced to enhance investment sophistication and drive progress. This is expected to increase the demand for financial securities in the long run.

On the supply side, there has been increased activity from companies. Banks, telecoms, and other utilities have issued or are planning to issue bonds and equities on AMX. This trend is promising as it indicates a rise in company investment activity beyond traditional bank financing. However, despite the positive trend, current sector numbers remain low compared to regional countries.

The area where significant progress has been made over the past few years, in terms of positive economic impact, is private equity finance. This refers to private investments into the equities of companies not listed on the stock exchange. However, private equity investments into established companies for restructuring and promoting growth and profitability constitute around 0.2% of Armenia’s financial assets.

The impact of early-stage private equity investments on the other hand, specifically venture finance into innovation startups, has been remarkable. This impact is significantly higher compared to traditional finance channels. In recent years, Armenia has built an innovation ecosystem that competes or even surpasses many of its more developed counterparts.

Startups founded by Armenians, both in the Diaspora and within Armenia itself, have valuations many times higher than the most established domestic companies. Through angel investor networks and venture capital funds, Armenia has attracted not only capital but also technology and science expertise from the diaspora, including network access in major innovation centers like Silicon Valley.

Armenian startups are regularly featured in leading international startup news outlets and continue to secure investments from reputable global venture capital funds. This further validates their potential. For instance, ServiceTitan, a startup founded by Armenians, may launch an Initial Public Offering (IPO), a rare occurrence even in competitive innovation ecosystems.

These successes are not likely to be one-off occurrences, given the substantial public and private efforts invested in developing domestic technology, innovation, and science talent. For Armenia, technology is of critical importance, particularly given its limited resources and geographical limitations. There are several countries that have essentially ensured their sustainability through this specific approach.

Despite the high potential impact of these investments per unit of currency, the volume of financing remains very low. Only about 0.06% of domestic financial assets are directed towards venture finance, a figure 25 times lower than in leading innovation ecosystems. A significant portion of this capital comes from the diaspora, while local and particularly institutional participation, a common practice in developed countries, is yet to gain momentum. Despite this, the subsector still has considerable room for improvement, given its encouraging progress and promising future impact potential.

Armenia has established a robust and well-regulated framework of the financial system over the years. However, the allocation of finance is less than optimal. A more diversified distribution of funding to various private sector activities could have a much more positive impact on the evolution of future economic outcomes.

Sources:

Central Bank of Armenia

European Central Bank

Part 1

Do Our Financial Habits Matter for Shaping the Future?

Defying expectations, Armenia has been enjoying some very strong economic growth. However, local consumption-savings habits and other factors continue to hinder local production and competitiveness. Samson Avetian explains what needs to change.

Read moreJanuary

on EVN Report

Politics

EU, U.S. Elections Could Test Armenia’s Resilience

As the geopolitical landscape in the South Caucasus remains precarious, potential changes in EU and U.S. leadership can pose additional challenges for Armenia. Amid these uncertainties, Armenia's diplomatic efforts become increasingly important and serve as a test of its resilience.

Read moreHypocrisy and Mystification: Azerbaijan in the Non-Aligned Movement

The Non-Aligned Movement is a diplomatic platform where Azerbaijan, as a major oil-producing nation, tries to exert influence by supporting ex-colonies that are purportedly fighting colonialism. Garren Jansezian explains.

Read moreOpinion

Conflicts Fueling Geopolitical Dynamics in 2024

2024 has gotten off to a bad start, with several destabilizing fires fueling the specter of a widespread conflict. In these circumstances, Armenia must opt for a global view of the regional situation, writes Tigran Yegavian.

Read more“Western Azerbaijan”, Pan-Turkism and International Law

This article presents a comprehensive perspective on the concept of “Western Azerbaijan,” portraying it as a continually evolving agenda that Azerbaijan might be integrating into a broader framework of bolstering Turkish influence in the Caucasus.

Read moreRaw & Unfiltered

The Rise and Fall of the Hunchak Party

For the first time, a book in English traces the history of the Social Democrat Hunchak Party, which has been largely overlooked in Armenian historiography.

Read more