Illustration by Armine Shahbazyan.

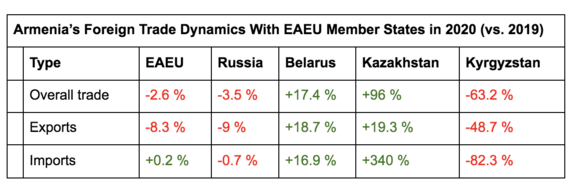

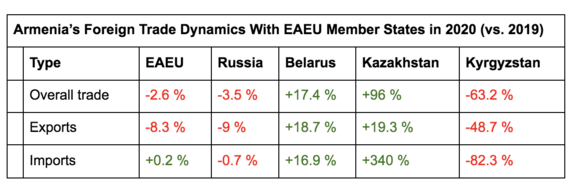

2020 was a year of crisis for all Eurasian Economic Union (EAEU) member states. As a result, mutual trade suffered as well. Armenia experienced a worrisome 3.9% drop in general exports in 2020, but exports to EAEU member states in the same year saw an even sharper 8.3% decline. Indeed, the obstacles that EAEU member states faced within their domestic markets also had an impact on mutual trade.

One of the main aims of integration into the Eurasian Economic Union is the guarantee of a single internal market for the free movement of goods, services, capital and labor. This requires systemic work geared toward alleviating existing obstacles within the EAEU’s internal market – work that needs a strong theoretical and methodical foundation, as well as necessary administrative and organizational tools.

For Armenia, the drop in foreign trade with EAEU member states was due to Russia and Kyrgyzstan. However, trade with Belarus and Kazakhstan actually grew. Specifically, the export of Armenian canned fruits and vegetables to Belarus and jewelry to Kazakhstan grew. We can assume that foreign trade with EAEU member states will slightly increase due to the temporary six-month ban on the import of Turkish products into Armenia that came into effect on January 1, 2021.

Currently, there are 71 obstacles registered within the EAEU internal market 53.5% of which are limitations due to existing shortcomings in the Union’s legislation; 26.8% are due to contradictions with the May 29, 2014 Agreement on the EAEU and 19.7% are authorized exceptions.

In 2020, Armenia presented the following issues as the most sensitive obstacles in the EAEU internal market:

1- Within the framework of EAEU membership, due to Armenia’s geographical location, customs control over goods transported from Armenia to other EAEU states are still in force. Specifically, Armenian businesses are faced with obstacles regarding the free movement of goods when crossing the Upper Lars border checkpoint between Georgia and Russia. Armenian goods go through customs control the same way goods are controlled from a third country. This includes unloading, sampling and examining goods. Additional documents are required that do not apply to other EAEU countries, for example a country of origin certificate, and an examination certificate from Armenia’s Chamber of Commerce and Industry.

2- According to the September 2, 2016 decision by Russia’s Federal Service for Veterinary and Phytosanitary Surveillance (Rosselkhoznadzor), the supply of sujukh and basturma meat products to most of Russia was banned. This decision was justified by vaccinations that had been carried out against hoof-and-mouth disease in a so-called “green zone,” and the supply of Armenian meat products to that zone had been deemed not to be safe. It should be noted that Moscow is considered a large logistical center, from where Armenian suppliers send their goods to other Russian cities (Khabarovsk, Novosibirsk, etc.), as well as other countries (Kazakhstan, Uzbekistan, etc.). Due to this ban, Armenian businesses are being forced to send their sujukh and basturma to those “green zones” by air, which in turn increases the price of each unit by 50-60%. It should be noted that these goods can receive a Russian veterinary certificate from the “green zone,” after which they can be legally supplied throughout all of Russia through distributors. At the same time, these products are also sold in large quantities in Moscow and other cities without undergoing the appropriate laboratory tests in Armenia, nor in Russia. This is due to the fact that these products end up on store shelves through the so-called “suitcase” route.

3- On June 26, 2020, the Russian Federal Law on Viticulture and Winemaking in the Russian Federation came into force, which implemented additional and stricter requirements in the production of alcoholic drinks. This law contradicts the EAEU Technical Regulation on Alcohol Safety, which came into force on January 9, 2021. To fix this situation, the EAEU Council passed Regulation N. 52 on October 30, 2020, which foresaw proposing that the Russian Federation make changes to its legislation on cognac distillate and fruit wines. Currently, changes regarding cognac distillate have been made and Russian companies are now accepting Armenian cognac once again. However, the situation with wine has not changed. As a result, the export of Armenian alcoholic drinks to Russia drastically dropped in 2020. Throughout 2020, 160.1 billion AMD worth of alcoholic drinks were produced in Armenia, a reduction of 12.9% or 15.9 billion AMD from 2019 figures. This included 92.6 billion AMD worth of cognac (20.5% decrease), 10.1 billion AMD worth of grape wine (24.7% decrease), 44.9 billion AMD worth of apple and berry-based wine (4.2% decrease), and 9.3 billion AMD worth of beer (11.2% decrease).

It should be noted that these issues are now at different regulatory stages.

If the existing obstacles within the internal market of the EAEU are solved quickly and effectively, it can create opportunities for mutual trade to grow. This would make the EAEU more appealing as one of the directions for regional integration.

also read

Armenia-EU Relations: Understanding CEPA

The Comprehensive and Enhanced Partnership Agreement between Armenia and the EU came into force on March 1, 2021. Will it serve as a stepping stone to develop and extend the scope of the partnership?

Read moreCurrent Trends in Armenia’s Real Estate Market

Economist Suren Parsyan writes that due to the pandemic and the post-war situation, Armenia is witnessing a decline in purchasing power, a phenomenon that is having an impact on the real estate market.

Read moreOpening Borders: Armenia’s Economic Risks

The lifting of blockades is presented as a benefit for Armenia, but some business leaders doubt that the Government is prepared for accompanying risks to the Armenian economy.

Read more