Looking at Armenia’s economic structure and the available statistics, it’s safe to say that spending and savings preferences are quite distinct compared to international benchmarks. Several hypotheses have been proposed to explain this.

One is that many lost their savings after the dissolution of the Soviet Union in the early 1990s. This event wiped out funds and reportedly continues to affect financial habits due to lingering trauma. There appears to be some trust issues with regard to financial institutions in Armenia. Surveys show that although on average 40% of people save money, a low number in itself, a mere 6% do so at a financial institution.

Whether the events of the 1990s left such a durable impact on households is debatable. Other post-Soviet republics undergoing similar transitions boast higher trust in their financial systems. Moreover, Armenia’s banking system has been very well regulated for at least two decades, with no banks going bankrupt in over 20 years. This is a stark contrast to places like the UK and France, where over a dozen banks have gone bankrupt, and the U.S., which has seen over a thousand bank failures in the same period.

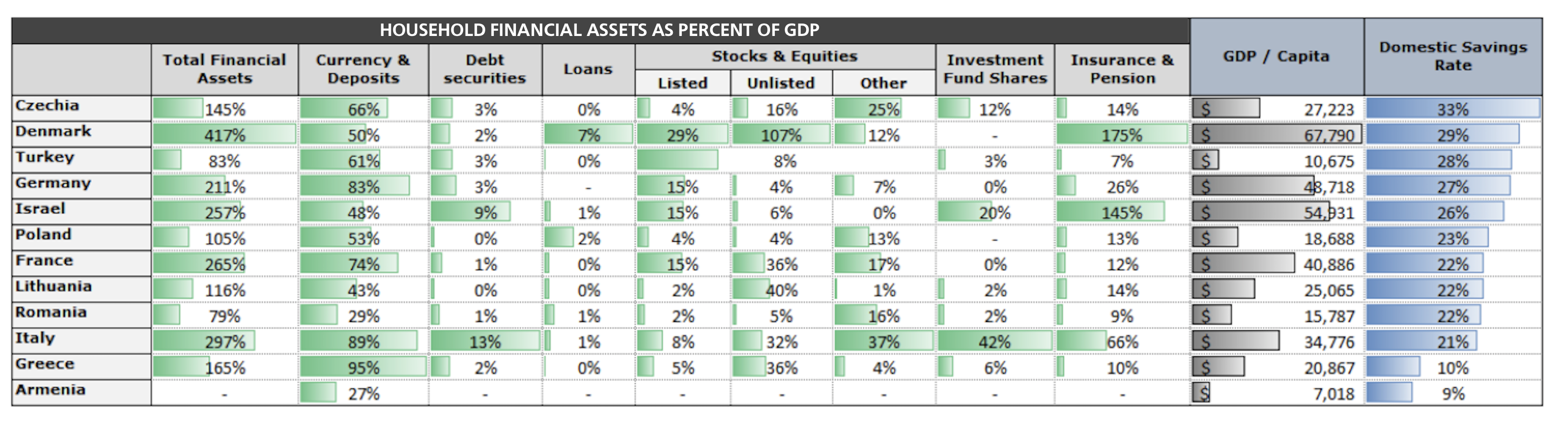

Another argument raised is that low income levels in Armenia could be responsible for low savings allocations; people simply don’t earn enough to save. But a statistical review of countries with comparable income levels reveals many instances where savings rates differ substantially.

While it’s important not to dismiss the influence of anecdotal evidence and societal norms, attributing them as the main cause of differences across nations would be an oversimplification. A more nuanced approach would highlight the lack of information and awareness-raising efforts about the benefits of savings and investments, both personally and collectively. The inadequate provision of policy incentives is another significant differentiation between more developed and less mature nations.

While much emphasis has been placed on the overall economy and medium-term outcomes, our finances also have a direct, immediate impact on our personal lives, both in the short term and in the long run.

Firstly, whether we like it or not, research indicates a correlation between finances and happiness, at least up to certain income levels. It’s difficult to disagree with the fact that things like financial freedom and the ability to finance travel and healthcare can impact levels of happiness. Other surveys on financial wellness support this. For instance, financial stress among employees is the most common type of stress, at 57%. This is four times larger than the next stress category and affects employee productivity, turnover, and even company profitability.

Drawing a connection between inadequate personal finance management insights and instances of financial stress isn’t far-fetched. Greater awareness and knowledge of personal finance strategies and tools could likely improve many of the issues discussed above. The trade-offs between immediate consumption today and increased investment opportunities might not be as visible due to increased marketing efforts for options like buy-now-pay-later (BNPL) schemes.

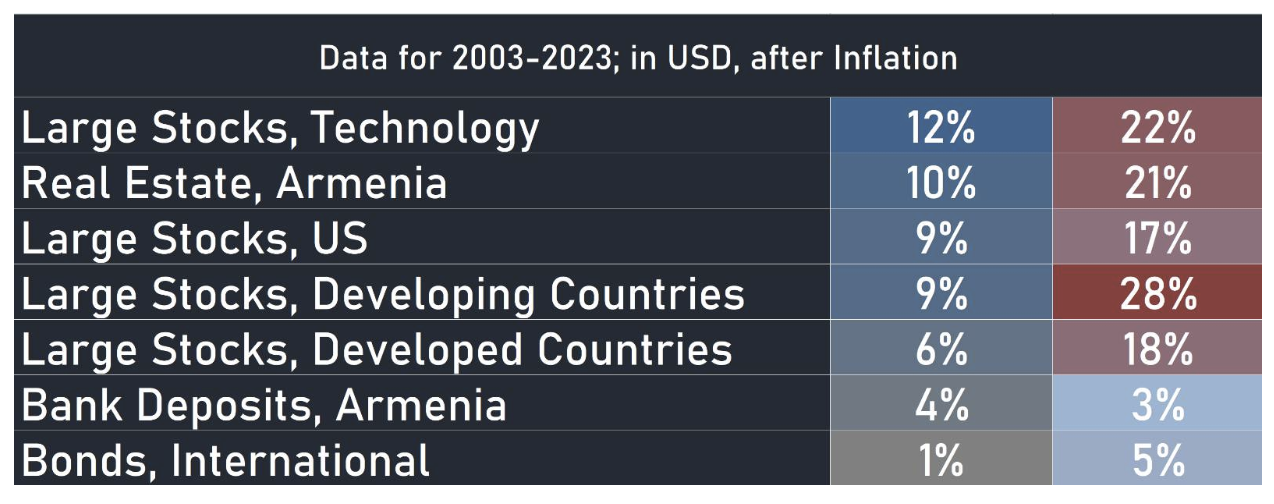

Perhaps Armenians are not as unfamiliar with investing as one might think, and the issue may lie more in the availability of investment products. Over the past few years, there has been significant private investment activity in the domestic real estate sector. New construction projects are being marketed specifically for investment, and anecdotal evidence suggests that people are also renovating their properties and basements for renting or reselling. It’s also common to see international real estate being marketed for investment in Armenia. Such intense local activity has led regulators and institutions to note significant price overvaluations. Hints of speculation, particularly with debt financed investments like mortgages, are always concerning. Prudence is advised, especially given previous experience elsewhere and not so long ago.

The accompanying table shows a more diverse picture, as demonstrated by international benchmarking. It is often said that the only “free lunch” in finance is diversification. Otherwise, if one wishes for higher returns, they must be willing to take on more risk.

In addition to more savings and investments, increased diversification is also something to strive for in Armenia. All investments have their own return, risk, duration, and liquidity profile. As such, constructing a diversified portfolio that aligns with one’s preferences, context, and financial goals becomes much easier. Planning, calculating, and implementing things like emergency funds, retirement planning, passive income, or other goals becomes more manageable. The table of historical returns and risks also allows for a comparison of various local and international investments assets.

In recent years, most of these assets have also become available to local investors for better returns, diversification, and risk management. Finally, sometimes the question is raised whether owning international securities is beneficial. The best investments are often spread across multiple countries, and holding foreign assets such as Google or HSBC shares can yield dividends and interest, much like Armenian assets for foreign investors. This also positively affects the local exchange rate and boosts domestic exports.

To summarize, and hopefully with more awareness efforts across the investment sector, things will advance in a more accelerated fashion. This progress should align with international benchmarks, improving personal financial security, freedom and wellness. It should also leave a positive impact on Armenia’s future economic outcomes.

Part 1

Do Our Financial Habits Matter for Shaping the Future?

Defying expectations, Armenia has been enjoying some very strong economic growth. However, local consumption-savings habits and other factors continue to hinder local production and competitiveness. Samson Avetian explains what needs to change.

Read morePart 2

The Need to Diversify Armenia’s Financial System

Banks make up the largest portion of Armenia's domestic financial system, accounting for approximately 79% of its total assets. While the banking system is well-regulated and devoid of bankruptcies for more than two decades, Armenia needs to diversify its financial system to ensure growth and prosperity.

Read more