On February 24, 2022, Russia invaded Ukraine. After months of posturing and mobilization along the eastern borders of the Donetsk and Luhansk oblasts, the Russian government formally recognized the independence of the Donetsk People’s Republic (DPR) and Luhansk People’s Republic (LPR), which had declared independence from Ukraine in 2014, and authorized a military intervention. While many analysts and observers anticipated a westward advance from the occupied territories of Eastern Ukraine or an otherwise limited engagement in the areas surrounding the DPR and LPR, what came instead was an attack on the entirety of Ukraine. Cruise missiles struck targets across the country and paratroopers descended upon Kyiv while mass formations crept toward the capital from the north, east and south. The American and European response to this crisis has been equally as momentous. Between the remilitarization of German government spending, support for NATO membership among traditionally neutral countries, and new formal applications for EU membership by Ukraine and Georgia, it feels as if the geopolitical landscape of Europe has been completely reshaped in just one week.

In his address preceding the “special military operation” in Ukraine (he insists that it should not be called a “war” or an “invasion”), Vladimir Putin directly acknowledged the multifaceted response that Russia was anticipating from the international community. In reference to “economic threats” and “brash and never-ending blackmail”, he directly acknowledged the coming economic strain: “Let me reiterate that we have no illusions in this regard and are extremely realistic in our assessments.” Sanctions are not a new concept to the Russian public and are one of many factors that have shaped the eight years following the annexation of Crimea in 2014. However, what distinguishes this recent round of sanctions is the disconnection of several Russian financial institutions from a network known as “SWIFT”. This article will examine what SWIFT is and how blocking Russia from accessing it could impact the Armenian economy. This article will also explore SWIFT’s sister networks, such as CIPS and SPFS, and look to Iran as an example of what trade with a post-SWIFT state may look like.

What Is SWIFT?

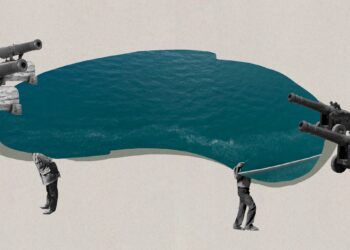

SWIFT refers to an international network developed in the early 1970s that is used to facilitate the movement of money between banks and financial institutions. More specifically, SWIFT is a protocol registered by the International Organization for Standardization (ISO) that is used to establish mutual communication between financial institutions and provide destinations for the delivery of money in wire transfers, bank payments and everyday transactions. The network’s name is an acronym for the “Society for Worldwide Interbank Financial Telecommunication”, referring to an official cooperative in Belgium that oversees the network. While SWIFT is designed to not be directly under the jurisdiction of a single country or political entity, the cooperative and its affiliated network are managed by board members appointed by the G-10 countries (Belgium, Canada, France, Germany, Italy, Japan, The Netherlands, United Kingdom, United States, Switzerland and Sweden) and the European Central Bank. While Western Europe is particularly overrepresented among the network’s board members, it’s worth noting that SWIFT is used for virtually all international financial transactions throughout the world, even if both banks involved are located outside of the G-10 or the jurisdiction of the European Central Bank.

On February 24, 2022, the United States and European Union announced that a collection of Russian banks and corporate entities would be disconnected from the SWIFT network in response to the ongoing invasion of Ukraine. This decision and its associated sanctions package have had a severe impact on the Russian economy. Russians have queued at ATMs across the country in response to the ongoing collapse of the ruble exchange rate. At the time of writing, the exchange rate is 4.5 AMD to 1 RUB (or 109 RUB per 1 USD), reflecting a nearly 30% decrease in value over the span of a week. The closure of commercial airspace and cancellation of many aircraft leases and spare part delivery has essentially grounded Russia’s commercial air fleet, while Norway’s Sovereign Wealth Fund has divested from all of its Russian holdings.

The disconnect from SWIFT was largely in line with previous “smart sanctions” deployed by the United States following the annexation of Crimea. As part of this strategy, sanctions are levied against specific individuals and institutions rather than the entirety of Russia. The purpose of this model of economic countermeasure is to focus on the impact of sanctions on a select few decision makers in the Russian government and oligarchy, rather than the average citizen of Russia. However, this technique has not insulated the average Russian citizen from the downstream contractions in the Russian economy. Additionally, the disconnect from SWIFT presents an immediate disruption to essentially the whole country. Services like ApplePay have stopped working in Russia, and many Russians are unable to use online marketplaces, while the price of food and other necessities skyrockets across the country. The U.S. Treasury Department immediately provided a list of targeted institutions, while the European Union published its list of targets on March 2, 2022.

Collateral Damage

Simply put, Armenia benefits from a strong Russian economy. Years of high economic growth in Russia are reflected in higher remittance rates (Armenian workers sending money to their families back home), a greater volume in trade, and higher amounts of Russian Foreign Direct Investment (FDI) in the Armenian economy. In years where the Russian economy has underperformed or contracted, the Armenian economy slows down as well. Examples of this include 2014 and 2015, when the contraction of the Russian economy following the implementation of sanctions by the European Union and United States was reflected in a sluggish Armenian economy. Although efforts have been made to engage with the world economy by transitioning toward an information economy and embracing concepts like digital industry in Armenia, Russia remains Armenia’s largest trading partner and is heavily represented in virtually every section of the Armenian economy. Additionally, despite the disparities in size between both countries’ economies, Armenia’s trade balance with Russia is relatively equitable. When we consider that Armenia’s trade with its second-largest trading partner, the European Union, is based almost entirely on the extraction of rare metals by a small collection of corporate entities, we can see that a shock to the Russian economy could impact nearly all elements of Armenian commercial activity.

Russia’s disconnect from SWIFT holds grave consequences for Armenia and the Armenian economy. VTB Bank Armenia is explicitly named among the subsidiaries of Russian banks targeted by the disconnect. According to the Central Bank of Armenia (CBA), account holders of VTB Bank’s Armenia subsidiary can expect continued service with certain difficulties in processing international transfers, as the bank is under the direct jurisdiction of Armenia. It remains unclear whether service availability will change after the initial grace period, as well as whether “international transfers” refers to transactions between Russian and Armenian accounts or between Armenia and third parties outside of Russia. Neither Gazprom Bank nor its Armenian subsidiary are mentioned in the Treasury Department’s statement, although Gazprom as a whole is mentioned. At the very least, this means that it may become considerably more difficult (if not outright impossible) to move money between Armenian bank accounts and any Russian financial institution targeted by the disconnect. This may affect remittance flows from Armenian citizens working in Russia and disrupt any commercial activity tied to a Russian bank. Roughly 10% of Armenia’s GDP comes from remittances, with the bulk of that figure coming from the Russian Federation. When we consider how common it is for Armenian families to supplement their income from a relative working in Russia, the effects of this disconnect would be felt particularly hard on the country’s working class and poor. Additionally, an individual living in Armenia who uses a bank account based in Russia may be unable to access their funds. This group may include students or diasporans who make use of the simplified and integrated laws for movement of persons and residency for citizens of both countries.

Looking South

Given that the sanctioning of the Russian economy and Moscow’s disconnect from SWIFT are directly tied to Russia’s invasion of Ukraine, the timeline for how long such measures may remain in place remains unclear. However, when imagining what trade with a disconnected and heavily sanctioned Russia may look like, Armenia only needs to look toward Iran. While Tehran has been under heavy sanctions for decades, minor commercial activity and commerce between Armenia and Iran is still possible. This is because, while the Iranian border is one of Armenia’s two open international crossings, Yerevan still complies with the sanctions regime levied by the United States and international community. Failure to do so by the Armenian government would run the risk of Armenia being considered a willing partner with the Iranian government in sanctions evasion—which would lead to extension of sanctions against Armenia. Tehran was disconnected from SWIFT in 2012 in response to the Iranian Nuclear Program and only partially reintegrated to the network in 2016. With these factors in mind, there is a noticeable sense of caution in how the Armenian government facilitates major transactions with the Iranian government. Natural gas purchased from Iran via the Armenia-Iran Gas Pipeline is paid for by Yerevan through the transfer of electricity through both countries’ shared power grid. For Armenia and Iran, this exchange of energy is a viable means of handling such a transaction, as it neither violates elements of sanctions law related to money transfers, nor is dependent on networks like SWIFT. Should Armenia find itself unable to purchase Russian gas through traditional financial means due to sanctions levied against Gazprom, perhaps this commodity-based trade could be used with pre-existing pipeline infrastructure.

Beyond trade and commercial activity, the sanctions and financial limitations on Iran have had a direct impact on individual Armenians. In 2018, many Iranian-born Armenians found themselves personally affected by a new series of strict sanctions against Iran by the Trump administration. Members of the Iranian-Armenian diaspora found themselves briefly unable to access their bank accounts in Armenia due to the possibility that their accounts may constitute a violation of the sanctions policies set forth by the United States. In some cases, these individuals were able to open new accounts in Armenia, but were provided debit cards that could only process transactions in Armenian drams – a limit which severely hampered the functionality of the cards given the interconnected nature of transaction processing. While it remains unclear as to what extent Russia’s SWIFT disconnect and sanctions will impact the Republic of Armenia, we have already seen cases in recent history where Armenians have been personally affected by international sanctions due to their nationality.

Cultivation of SWIFT Alternatives

Since the early 2000s, Russia has vocalized a desire to move beyond the privileged role of the US Dollar and western financial institutions in international finance. This was part of the Russian government’s promotion of a “multipolar world” and was articulated in projects like BRICS and the New Development Bank (BRICS Bank). However, it was only after the U.S. and European Union instituted heavy sanctions following the annexation of Crimea in 2014 that the Russian government began seeking viable alternatives to payment systems like SWIFT. One example, known as the “Cross-Border Interbank Payment System” (CIPS), is used in mainland China as a means of processing bank transactions. While CIPS is primarily designed for handling the domestic market in China, the system is also used to facilitate UnionPay transactions abroad. Additionally, through a Memorandum of Understanding signed in 2016, both the CIPS and SWIFT networks are capable of communicating with one another. Observers have suggested that, in an effort to minimize the impact of the SWIFT disconnect and recent round of sanctions, Russia may look toward CIPS as an alternative payment processing network. However, this proposition does not take into account CIPS’ relatively limited usage in the global economy compared to SWIFT, nor that CIPS and SWIFT are complementary payment processing networks rather than competing systems—i.e. CIPS can be used as a vehicle to access the SWIFT network, but cannot be used as an alternative to processing SWIFT transactions.

In 2014, the Russian Federation created a payment network known as the SPSF. While considered to be part of a wider set of integration policies within the Eurasian Economic Union (EAEU), SPSF was developed specifically to provide an alternative means of transaction processing in Russia in the event of a SWIFT disconnect. A total of 23 foreign banks have joined the SPSF network. Members of the network include banks in Germany, Switzerland and the five members of the EAEU, along with potential linkage with CIPS and expansion into Turkey and Iran. While SPSF has been used to process transactions between parties in Russia, it has yet to see incorporation into any cross-border institutional transactions. In many ways, SPSF suffers from a similar limitation that CIPS faces in that, while it can emulate the functionality of SWIFT, it cannot process transactions involving parties outside of its network and is primarily used for domestic transactions in Russia. That is, if you want to transfer the money to a bank in the United States, that U.S. bank must be a member of SPSF (which currently none are). Additionally, circumventing SWIFT limits with SPSF could mean the potential extension of a SWIFT disconnect to other members of the Eurasian Economic Union—a stance which has already been vocalized by some hawkish observers.

Cryptocurrencies and Sanctions Circumvention

In exploring alternatives to SWIFT, certain state bodies and financial institutions in Russia have considered using cryptocurrencies and other digital assets as a means of facilitating financial transactions. In these arrangements, cryptocurrency would either be used as a commodity or as a literal currency in a transaction. The Russian government has approved a variety of initiatives related to the incorporation of cryptocurrencies into state finance and has established regulatory and legal frameworks for digital assets. In trading cryptocurrencies, some Russian actors have used tools to obfuscate recipient and sender addresses in a public blockchain ledger to outside observers. What that means is that Russia has laid the groundwork for a means of illicit state finance, similar to that of Iran and North Korea, and leaned into its growing domestic market for ransomware and digital theft. While members of Armenia’s IT industry have enthusiastically supported the proliferation of cryptocurrencies and mining operations as part of the country’s involvement in the wider digital economy, using such digital assets as a vehicle for international finance would be an incredibly risky decision. To begin, considerable legal work would have to be done in outlining how exactly digital currencies would be recognized by the Republic of Armenia and what exactly would be their relation to the country’s financial institutions. This is because there is no law in Armenia governing the trade, sale, taxation or regulation of cryptocurrencies. Additionally, cryptocurrencies are designed to be decentralized and outside of the control of a governing body or authority. This results in an inherently high level of volatility and instability that would present an immense challenge for any individual, firm or state actor looking for a stable monetary unit for a large transaction. Finally, there is the reality that, even if such an unconventional financial tool were to be a viable alternative to SWIFT in processing international transactions between Armenia and Russia, many cryptocurrency exchanges would be unable to trade the currency out of fear of violating sanctions law. This means that, even if an Armenian entity were to use cryptocurrency as a means of continuing trade and commerce with its sanctioned Russian counterpart, the currency used in the transaction may not be redeemable and therefore useless.

Weathering the Storm

In navigating the ongoing fallout of the Russian invasion of Ukraine, it is crucial that Yerevan works to prevent the potential extension of SWIFT limitations and sanctions to Armenia. This means balancing the continued movement of funds between Armenia and Russia while ensuring that SPSF and SWIFT remain distinct networks that are insulated from one another. It is of the utmost importance that Armenia does not position itself as a willing partner in sanctions evasion. This is a role that has been taken by Belarus in the past and that some believe Azerbaijan may try to emulate in the near future. Armenia does not have the deep political and economic integration seen in the Belarus-Russia “Union State”, nor Azerbaijan’s historical impunity that stems from owning one of the world’s largest energy supplies. Perhaps one of the best tools at Armenia’s disposal is its presence in Russian-led regional integration projects. After approving CSTO intervention in Kazakhstan in January 2022, Armenia is likely to rule out deployment of the alliance’s joint forces to Eastern Ukraine. Given that the EAEU operates based on consensus between its members, it may be possible for Armenia to use its presence in the union as a means of preventing its usage as a tool for sanctions evasion. Considering that Kazakhstan has not expressed support for Russia’s military activities in Ukraine, and Kyrgyzstan is in an equally precarious economic state as Armenia, this position may have wider support among EAEU members than imagined. With two major trading partners under heavy international sanctions, Armenia may also lean toward deepening its trading relations with the Transatlantic Community and working toward the long-term diversification of trading partners recommended by the United Nations Economic Commission for Europe (UNECE).

Also read

The Context Behind Armenia’s UN Vote on Ukraine

In its historic “Uniting for Peace” session, the UN General Assembly adopted a resolution reaffirming Ukrainian sovereignty, independence and territorial integrity. Sossi Tatikyan explains why Armenia abstained.

Read moreA Transparent Security Sector Accountable to the Public

Reviewing Armenia's national security policy and modernizing the Armed Forces should be based not only on the approaches and views of the government and other state bodies, but also on the active cross-section of civil society.

Read moreRussian Policy Changes in the Nagorno-Karabakh Conflict

What has Russia’s policy positions and long-term shifts been toward the Nagorno-Karabakh conflict as the issue has become more nuanced and complicated over the decades?

Read moreNavigating a Changing Geopolitical Current

The rise of China has shifted the geopolitical center of gravity to the Indo-Pacific. What does this paradigm shift entail? How can Armenia navigate the transition and find its place on the world stage?

Read moreAzerbaijan’s €2 Billion Shakedown

By meeting Azerbaijan’s demand for a €2 billion financial package to participate in “restoration and reconstruction”, the European Union is casting into doubt its sincerity in supporting democratic values in the South Caucasus.

Read moreDeconstructing the Divide: Armenia and Ukraine in Modern Eurasia

Armenia and Ukraine seem to have found themselves diametrically opposed on a variety of issues. However, Yerevan and Kyiv would benefit from a pragmatic relationship despite their seemingly disparate positions.

Read moreHow Important Is Armenia to the United States?

The strategic limitations of the last 30 years are no longer tenable, and there is an acute need for innovation, creativity and sophistication in creating a new chapter in U.S.-Armenia relations.

Read moreRusso-Turkish Wars Through History

This new series presents the Russo-Turkish wars of the 19th-20th centuries, which were of crucial importance for the two segments—eastern and western—of the Armenian people.

Read moreThe Endless Geopolitical Struggle

Western attempts to infiltrate into the sphere of Russian influence have meant to weaken Russia and maintain constant tension. Could this result in larger clashes with more unpredictable consequences, this time between large geopolitical players?

Read moreTurkish-Georgian Economic Relations: A Case Study

Turkey is Georgia’s main source of imports and finances strategic infrastructure such as energy projects. The imbalanced arrangement provided Turkey with “strategic depth” and opportunities for power projection. Armenians are apprehensive about the repercussions of going in the same direction.

Read more