Illustration by Armine Shahbazyan.

Following the war in Ukraine, several Russian and Ukrainian companies relocated and registered their businesses, mainly in the IT sphere, in Armenia, giving hope for a faster boost to the sector. More recently, Armenian authorities reported that NVIDIA, a leading U.S.-based multinational tech company, planned to open a research center in Armenia.

The development of Armenia’s IT sector may seem to be accelerating given the government’s continual pledges to transform the country to a knowledge-based economy, but such a transformation has yet to come to fruition. Armenia’s economy is still dominated by mining and producing goods like tobacco products.

The Armenian ICT sector stands in the middle of international indexes. The country is in 69th place [out of 132 countries] in the Global Innovation Index, 60th in the Network Readiness Index, and the 33rd among 137 countries regarding the “Quality Of Math And Science Education”, according to the Global Competitiveness Index database.

Armenian universities and private companies, such as TUMO, Microsoft, Synopsis and IBM, focus on STEM education, training young and ambitious professionals to join Armenian and foreign IT companies.

With all the positive changes, however, the Armenian IT industry faces challenges such as brain drain and, consequently, a lack of qualified specialists to work in the domestic labor market. Other issues also create obstacles to growth and generate risk for the companies operating in the country.

A number of Armenian IT firms operate internationally; some products created by Armenian IT specialists have become global hits in recent years. An example is AI-based Robin the Robot—created by Expper Technologies. Robin has joined hospital staff to help communicate with patients and their relatives in Armenia and abroad.

One of the best-known Armenian companies, Picsart, is valued at more than $1 billion. ServiceTitan—a tech platform for tradespeople—was founded by Armenians in the U.S. in 2013 and opened a branch in Yerevan in 2018. It is currently valued at $9.5 billion and reportedly aiming to double its valuation this year. Relatively new companies, such as Podcastle AI and Wirestock, have also managed to attract major investment and showcase promising prospects.

Yet, many of these firms follow a common pattern: they are either registered outside Armenia, in countries with a more favorable investment climate, or primarily service the international market, tailoring their products to foreign clients.

Government Strategy

The ICT sector was declared a priority for Armenia as early as 2000, kickstarting a number of programs and strategies to develop the sector. Following 2018’s “Velvet” Revolution, the Pashinyan Administration once again committed to supporting the advancement of the sector, creating a more favorable atmosphere for foreign investment, as well as supporting local small businesses and start-ups.

These changes have not gone unnoticed. Among other international outlets, Forbes has written about Armenia’s potential as a regional tech hub.

State support for IT companies comes in the way of legal regulations and direct financial assistance, including as part of the pandemic-related economic relief package.

The most recent policy was approved by the Government in late March 2022. It provides a 50% income tax refund for IT companies that hire at least 50 permanent or freelance employees.

When presenting the law, Head of the State Revenue Committee Rustam Badasyan said that one of its objectives was to bring those working “in the shadows” into the formal economy. Badasyan also noted that the regulation is aimed at supporting qualified professionals, to help them stay in the country and work for local companies under good working conditions.

According to the State Revenue Committee, after the taxes are returned the employer and employees should come to an agreement about the conditions either by increasing the salaries or not.

Armenia’s Ministry of Economy has expressed its willingness to help Russian, Ukrainian and Belarusian IT companies relocate and get registered in Armenia. The Armenian government sees this as an opportunity to further contribute to Armenia’s IT ecosystem, while aiding companies from war-affected countries to continue their operations.

The Armenian Government has extended tax breaks to IT companies for quite some time. Since 2015, new start-up IT companies with less than 30 employees are granted a full tax exemption for their first five years. In addition, employees that work in tech pay a lower 10% income tax rate, compared to the 21% flat tax that applies to everyone else.

During the optimization of the government and the reorganization of ministries in 2019, the Armenian government created a new Ministry of High-Tech Industry, which replaced the Ministry of Transport, Communication, and Information Technologies, to pursue and implement the government’s strategy of supporting the high technological productions. The ministry also included the military industry “given the importance of high technologies in the field of modern military industry.”

The government has also established several institutions and foundations aimed at helping local IT businesses. One of the first, the Information Technologies Development Support Council (ITDSC), was established in 2001 to become a facilitator between the Government, IT businesses, educational institutions, NGOs, donors and international organizations. In 2010, the Enterprise Incubator Foundation (EIF) was established with the goal of bringing Armenia’s IT sector up to international standards.

In June 2021, then-Deputy Prime Minister Tigran Avinyan announced that Armenia was going to adopt its Artificial Intelligence Strategy․ “The national AI development strategy and the resulting action plan should be considered a framework for coordinating and directing the stakeholders’ activities in order to pursue a common policy in this field,” explained Avinyan, adding that having such a strategy should be a “top priority for Armenia.”

According to him, the strategy should be a “consensus vision” for AI development and other specific measures to achieve it through close synergy between the government, the private sector and individual researchers. The strategy will address higher education, particularly doctoral and post-doctoral programs, public-private partnerships and other specific issues.

Avinyan said he believes Armenia can join the leading countries in the field and “pave the way for a technological breakthrough.”

Why IT?

Armenia’s economy is still highly reliant on the mining industry, whose companies are among the country’s largest taxpayers. That sector is still expected to remain the most important for the near future. Nevertheless, dependence on the mining industry is foreseen to grow significantly if the government chooses to go ahead with the operation of the Amulsar mine after all. Discussions over the operation of the mine had halted after drawn-out protests, resuming only after the 2020 Artsakh War, as Armenia reckoned with a difficult economic outlook.

The mining industry also offers competitive salaries to its employees. The average salary in the mining industry is over $1100/month, more than double the average wage of $500.

The ICT sector is seen as one route to diversifying the national economy, with the potential to compete with the mining industry in promising better working conditions and faster growth without having to worry about rooted corruption and environmental degradation.

Yet, the IT field in Armenia still has a long way to go.

The Zangezur Copper-Molybdenum Combine, for example, paid over 49 billion AMD in taxes in 2021, becoming the largest taxpayer in the country. In contrast, the 36 IT companies that made it onto the list of the country’s 1000 largest taxpayers paid a total of about 39 billion AMD. The largest among them was SoftConstruct, which specializes in gambling. Digitain, Synopsys and Picsart are also among the 100 largest taxpayers.

The average monthly wage in the information and communication sector starts at $900/month, increasing with experience and company valuations. With its relatively high wages, the IT sector has become a magnet for those seeking to join Armenia’s new middle class, especially for the well-educated younger generation.

The number of companies actively operating in the ICT space is over 1,300 as of 2021, an increase of over 500 compared to 2018. According to the High-tech Industry Ministry’s data the sector has over 15,000 “actively” employed workers, yielding more than one billion dollars annually. Yet, the number of professionals engaged in the IT sector is 25,000.

The average growth of the ICT industry is at 20% annually, including steady growth in 2020 despite COVID-19 lockdowns and the crises caused by the 2020 Artsakh War, when other sectors faced notable declines.

The desire to realize Armenia’s ICT potential is sincere. The questions arise when you zoom out to see the broader picture.

As Armenia’s tech sector is based mainly on start-ups and less on larger companies, the overwhelming majority of the firms, over 80%, have less than 25 employees, 13% have 25-100 employees, and only 4% have more than 100. The share of foreign companies, or companies owned by foreigners, remains high in the country, even though the state programs helped increase the numbers of local start-ups.

The U.S. State Department’s 2021 Investment Report described Armenia’s “investment and trade policy” as “relatively open”, with foreign companies entitled by law “to the same treatment as Armenian companies.”

“Armenia has strong human capital and a well-educated population, particularly in the science, technology, engineering and mathematics fields, leading to significant investment in the high-tech and information technology sectors,” the report reads.

According to the report, “considerable foreign investment in Armenia has occurred in the high-tech sector” as high-tech companies have established branches or subsidiaries in Armenia “to take advantage of the country’s pool of qualified specialists in electrical and computer engineering, optical engineering and software design.”

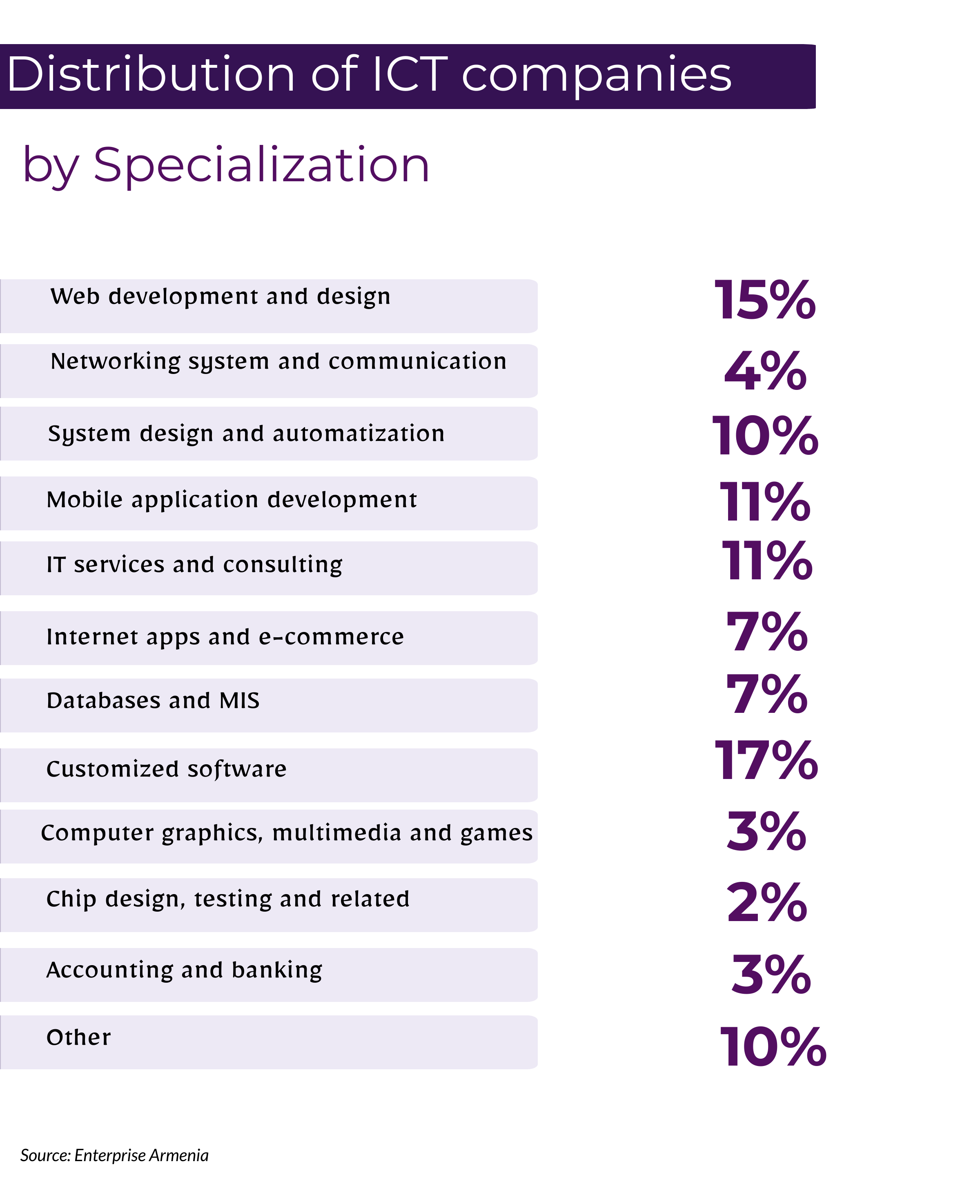

According to Enterprise Armenia’s data, over 17% of ICT companies are specialized in customized software, with another 15% in web design and development.

EVN Disrupt

Podcasts

Tigran Shahverdyan: Building Autonomous Systems

Tigran Shahverdyan, the co-founder and Chief Technology Officer of Robomart, joins us this week on EVN Disrupt to discuss how Robomart is attempting to make fresh produce more accessible through their "store-hailing" platform. We also discussed the future of self-driving vehicles, and Gituzh's initiatives to advance science in Armenia.

Read moreLilit Nersisyan: At the Intersection of Biology and Tech

This week on EVN Disrupt, Lilit Nersisyan, a bioinformatician and the founder of the Armenian Bioinformatics Institute (ABI), joins us to discuss the field of bioinformatics, its role in the world today, and what ABI is working on. We also discussed science commercialization, and the biotech industry.

Read moreMikayel Khachatryan: Enabling Creators to Sell Their Content Across the Web

Mikayel Khachatryan, the CEO and co-founder of Wirestock, joins us this week on EVN Disrupt to talk about how his company allows users to sell photos, vectors and videos online through multiple marketplaces at once. We also spoke about Wirestock’s experience in raising their seed round last year, and what they have planned for the future of the company.

Read moreGevorg Poghosyan & Armine Mkrtchyan: Encouraging Collaboration Through the reArmenia Platform

Gevorg Poghosyan, the CEO and co-founder of reArmenia, and board member Armine Mkrtchyan, join us this week on EVN Disrupt to speak about reArmenia, a crowdsourcing platform that encourages collaboration on a variety of projects in Armenia. We also spoke about the recent developments regarding regulating equity crowdfunding in Armenia, and how it can encourage more investment in Armenian companies.

Read moreHrant Khachatrian: Building a Research Lab From the Ground Up

Hrant Khachatrian, the founder and director of YerevaNN, a machine learning research lab, joins us this week on EVN Disrupt to tell us the story of how YerevaNN was built at a time when there was very little machine learning activity in Yerevan. We also spoke about the state of scientific research in Armenia and what is needed to significantly develop and boost research activity in the country.

Read moreAshot Arzumanyan: Investing in Armenian Start-ups

The first guest of the newly launched Creative Tech podcast series, "EVN Disrupt" is Ashot Arzumanyan, a partner at SmartGateVC, a venture capital fund focusing on early stage start-ups. We discussed the Armenian start-up ecosystem, how it has evolved over the last four years and what we can expect from the Armenian tech sector in the near future. 0:00 Introduction/ 0:52 Founding of SmartGate VC/ 3:50 Tim Draper's investment in SmartGate/ 8:28 Evolution of Armenia's start-up ecosystem/ 15:55 Rise of product companies in Armenia/ 19:04 Recent investments in Armenian start-ups/ 29:26 Hero House LA, Diasporan start-ups/ 35:19 Challenges/ 37:58 Future of SmartGate and the ecosystem

Read moreCreative Tech

Articles

BuildUp Bootcamp: A New Approach to Breaking Down Barriers to Professional Development in Armenia

Building cool products is one thing, successfully delivering them at scale is another. If the Armenian tech sector is to grow sustainability, it’s going to need to excel in both.

Read moreArmenia’s Start-Up Ecosystem

We are at an exciting inflection point for Armenia’s tech sector, as the potential for rapid growth and new activity in the coming years is high, writes Njdeh Satourian.

Read moreIT Startup Tax Incentives: Fixing the Wrong Problem

Armenia’s government has introduced a number of benefits for the tech industry. Will these benefits contribute to the development of the sector and are they sufficient to solve the existing challenges?

Read moreExports, Imports and the Foreign Market

The growth of Armenia’s ICT sphere is visible when looking at the production and services, and the numbers of specialists working in the field. The growth in these two indicators in 2021 was about 30% and 17%, respectively.

Until 2015, ICT sector revenue was mainly generated by foreign companies (companies with at least 51% ownership by foreign citizens or legal entities). In 2015, the share of local and foreign companies equalized, and locally-owned companies have taken the lead since then. One of the main drivers for the change was the law granting tax exemptions to IT companies.

The tech industry made up 4% of Armenia’s total GDP in 2021. This figure was higher in 2018, at 7.4%.

The 2021-2026 Government Programme aims to increase this figure from 4% to 5-6% in the coming few years. Given the big promises and state spending, the target can be considered less than transformative.

Armenia still imports more ICT goods than it exports. ICT goods exports were only 0.4% of total goods exports in Armenia; in 2018 and 2019, the share of ICT goods among Armenia’s exports was 0.3%. This figure peaked in 2001, when it was over 2%.

In 2020, Armenia exported a total of $28.7 million high-tech goods, by about $17 million less than in 2019 – the year before the coronavirus pandemic and the war. Exports dramatically grew starting from 2015-2016, when in one year, the amount of exports doubled, reaching $21 million in 2015 compared to 2016’s $11 million. Before that, the maximum amount of exported goods was less than $10 million.

The imports of ICT goods between 2018-2020 were over 5%.

High-tech exports from Armenia stood at 7% in 2020, actually down 2.7% compared to 2019. Back in 2007, high-tech exports from Armenia made up only 1.4% of total exports.

45% of the Armenian ICT exports are to Canada and the U.S., 25% to Europe, and 11% to Asian countries. Russia imports around 10% of Armenia’s total ICT exports.

Challenges and Opportunities

Thus, after all the support and attention from the government, the transformation of Armenia’s tech sector in terms of becoming a driver of a knowledge-based economy is still in the future. It is still an opportunity for young and qualified specialists to earn comparably higher wages. However, a 2020 World Bank report sees high-tech digital exports as key to Armenia’s economic growth. “With investment in tertiary research, Armenia’s strong heritage in mathematics could position it as a global hub for pure AI research,” the report reads.

Government investment in research and development has been low in recent years, and the World Bank report recommends Armenia pay more attention to improving the tech sector’s research capabilities, drawing foreign investment in this particular sphere.

According to industry reports, approximately a third of ICT companies in Armenia claim some foreign ownership. More than half of those firms are from the United States. Roughly half of those employed in the IT sector work for foreign firms.

While Armenia is considered to have relatively highly-qualified specialists, businesses often face challenges in “continuing to scale their operations, as quickening growth drives a demand for qualified talent that is outstripping local supply.” That is, the most qualified specialists are mainly being hired by foreign companies, either as freelancers or through immigration visas, causing human resources problems for the local companies.

The report forecasts difficulties for the Armenian market in competing for “mass-market solutions” amid the growing competition. It suggests that Armenia focus not only on the quality of high-tech exports but also on the “types” of exports, as the further development in AI and machine learning technologies may threaten traditional software development functions.

Thus, with a relatively good working environment, competitive salaries and the numbers of employed specialists, as well as with constant growth, the high-tech industry is becoming one of the fastest growing sectors of Armenia’s economy, it still lacks a significant progress to play a decisive role in the country’s economic growth, which is not expected to happen in the coming few years.

At the same time, the government’s commitment of paying special attention to the ICT sector and trying to encourage newly established startup companies should be done in parallel with a number of actions aimed at creating conditions to prevent the emerging brain drain in the sector and encourage young people choosing IT professions to fill the gap of in-demand high-quality specialists in both Armenia and abroad.

Additionally, Armenia’s ICT sector is being affected not only due to the issues specific to the sector, but the ones relevant for the country’s businesses in general.