Armenia’s statistics agency, ArmStat, recently released its annual report on a number of socio-economic metrics that cover everything from trade to tourism, and from employment to inflation.

While much of 2023 was marked in Armenia by the blockade and eventual ethnic cleansing of Nagorno-Karabakh (Artsakh), Armenia’s economy and trade continued to expand, albeit at a slower rate than in 2022. EVN Report has selected some of the most interesting findings and highlights that reflect the state of the country.

Economy

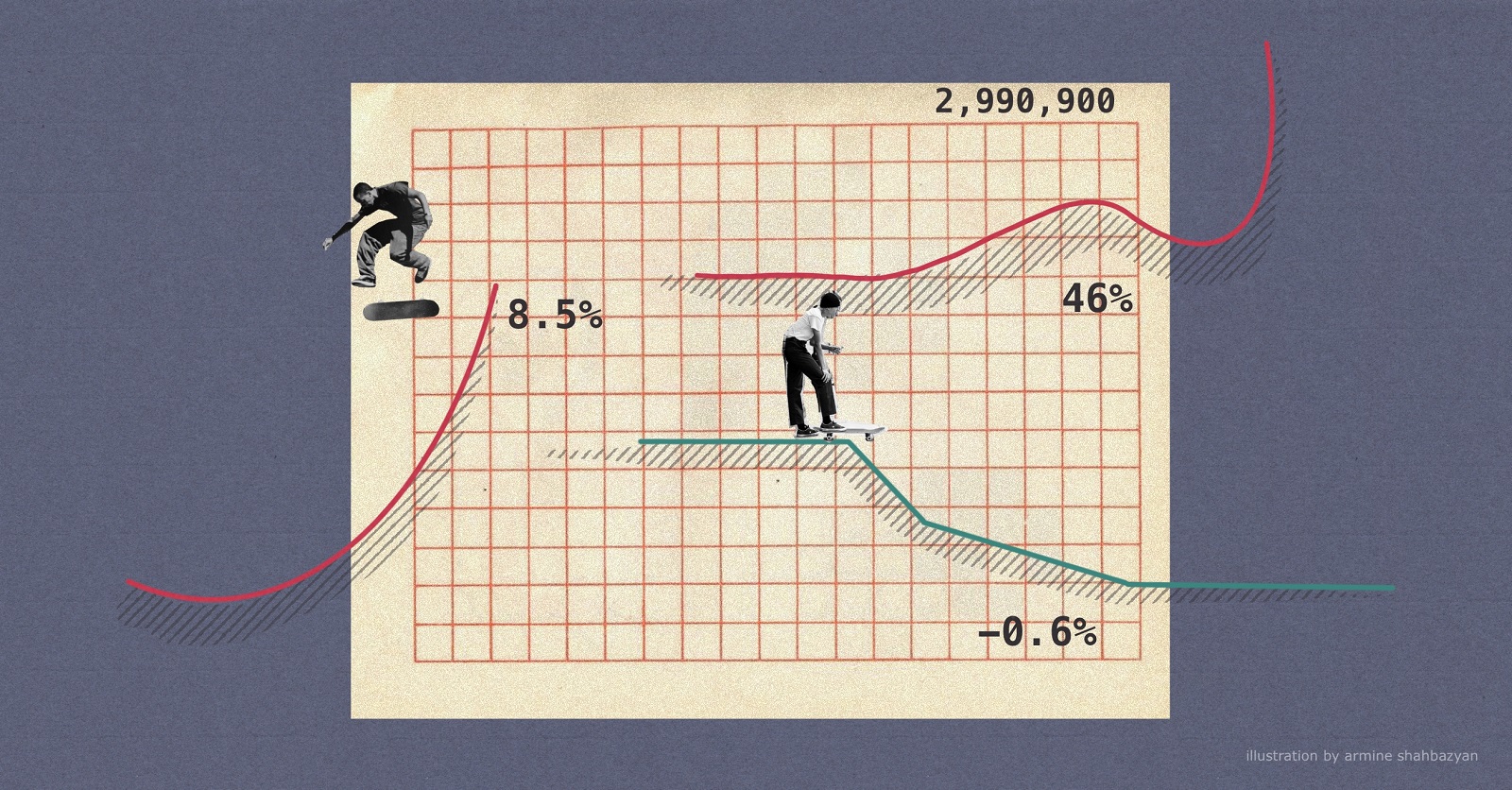

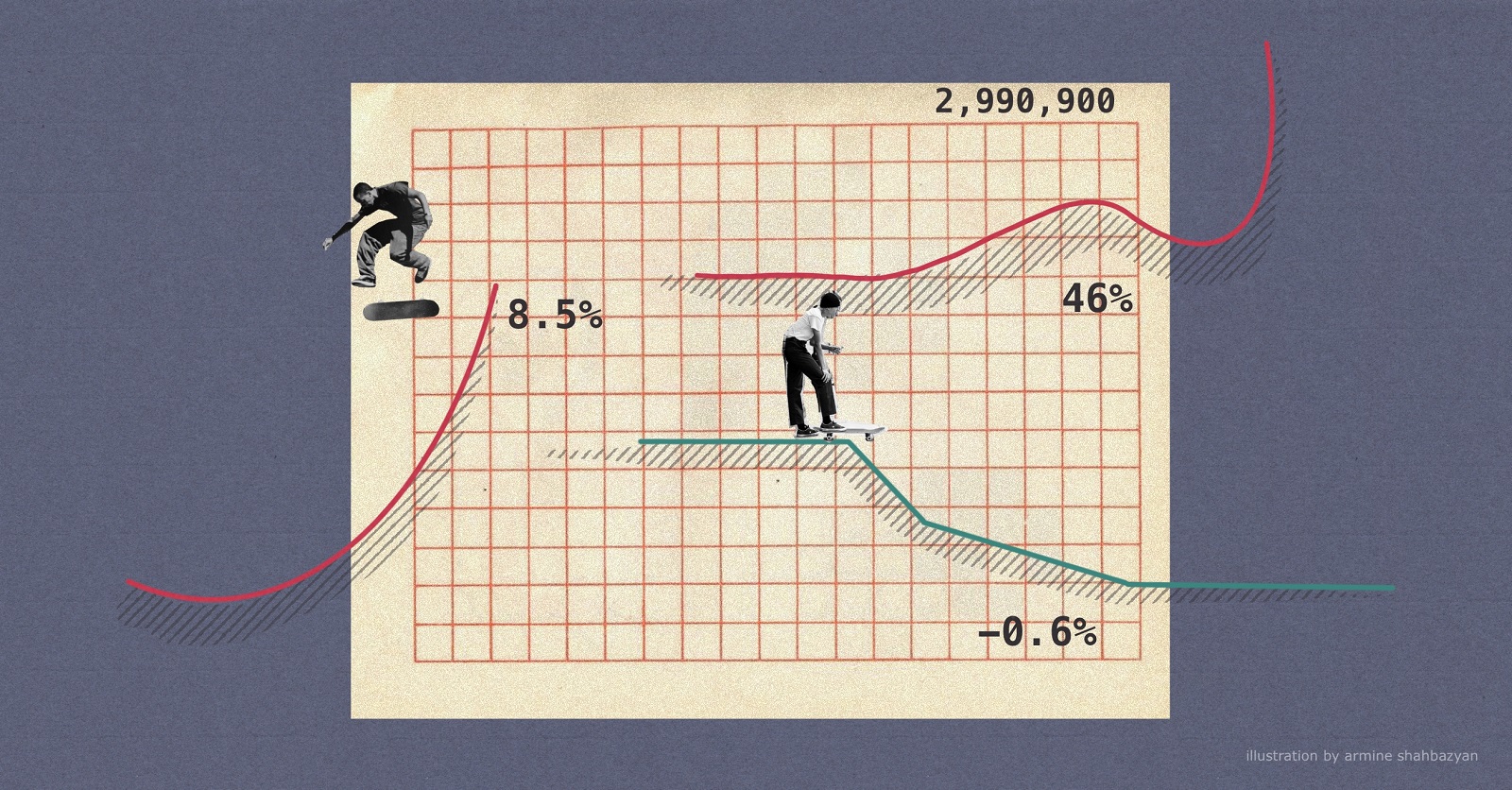

In 2022, Armenia recorded double-digit economic growth for the first time since 2007, at 12.6%. Although GDP growth remained robust, it slowed in 2023 and is forecasted at 8.3% to 8.5% by the Economy Minister. The indicator of economic activity for 2023, which is usually within a close range of the final GDP figure, stands at 9.4%.

Domestic commerce grew by 26%, construction by 15%, services by 10%, industry by 4%, while agriculture continued to stagnate, continuing the trend of recent years.

In 2022, services had experienced remarkable growth by nearly 25%. This growth significantly slowed last year, albeit with some sectors, notably the IT sector, still experiencing substantial expansion. It expanded by 52%, a slowdown from the 76% growth observed in 2022, attributed to the influx of Russian tech workers and companies. Air transport witnessed a 74% growth after having more than tripled in 2022. Restaurants and other food establishments grew by 25%, up from 17% a year earlier. After an explosive growth of nearly 68% the previous year, the banking sector declined by more than 8%, but bank profits remain high.

Growth in Industries also slowed, dropping from 8% in 2022 to 4% last year. The decline of mining accelerated, increasing from 3.2% in 2022 to 6.4% last year. Manufacturing growth slowed from 13.5% to 6.7%. Cigarette production grew by 16%, whereas food production declined by 5.3%. The production of base metals shrank by nearly a quarter after growing 16% in 2022. Jewelry production grew five-fold.

International Trade

Driven largely by re-exports to Russia, Armenia’s foreign trade expanded 46% after a boom of 69% in 2022. Total foreign trade in 2023 reached $20.7 billion, up nearly 2.5 times since 2019. Imports experienced a 40% increase, while exports grew by 55%.

Trade with Russia, which nearly doubled in 2022, experienced a more modest growth rate of 43% in 2023. Russia continued to account for more than a third of all trade, slightly above 35% like in 2022. The share of the EU, China, Iran all declined slightly, standing at 13%, 10%, and 3.3%, respectively. Trade with the UAE expanded almost four fold and its share jumped from 4.2% to 11%. Trade with the U.S. accounted for 3.2% of the total. Trade expanded significantly with South Korea (84%), Canada (82%), Japan (76%), while continuing to shrink with war-torn Ukraine.

The most remarkable growth was observed in the trade of precious and semi-precious stones and metals, which increased from almost $1.7 billion in 2022 to over $5.5 billion last year, representing a growth factor of 3.3.

Finances

Inflation, as measured by the Consumer Price Index (CPI), waned in 2023. CPI had climbed to 8.3% in 2022, but by December 2023, year-on-year CPI had shrunk by 0.6%. The index of food and non-alcoholic beverages declined by 5%.

The exchange rate of the dollar against the Armenian dram stabilized in 2023 after having dropped almost 15% from just above 500 AMD for 1 USD in 2021 to 435 in 2022. The rate in 2023 fluctuated between 386 and 404.5, averaging at 392.5.

Unemployment, Poverty and the Labor Market

The 745,207 employed people in Armenia as of December 2023 is the highest on record, up from 708,906 a year earlier, and 624,382 in Q4 2019. Of those, 28.8% are employed in the public sector, down from 32.6% four years earlier.

The sectors with the most employees are commerce (127,169), education (123,952), manufacturing (87,886), healthcare and social services (51,433), hospitality (39,243), public administration and defense (35,158) construction (34,796), and IT (31,989).

The average monthly salary for all employees was 333,162 drams ($824), up from 309,080 drams ($783) a year earlier. In the private sector, the average monthly salary stands at 346,377 drams ($856) and 300,529 ($743) in the public sector. The highest paying jobs in Armenia are in tech (1,206,534 drams or $2,983), finance (1,065,915 or $2,635), and mining (748,620 or $1,851).

In Q3 2023, unemployment stood at 12%, up slightly from the 11.6%, in Q3 2022, which was the lowest on record.

Poverty in 2022, according to the latest data available, stood at 24.8%, down from 26.5% the previous year. Poverty is measured by consumption (as opposed to income) per adult below 52,883 drams ($121) per month.

Demographics

Armenia conducted its decennial census in October 2022. In December 2023, ArmStat released the preliminary results, according to which the country’s permanent population, which also counts temporarily absent people, stands at 2.9 million. The resident population that counts only people present during the census stood at 2.7 million. The census found that nearly 64% of Armenia’s population live in cities and 36% in rural areas.

ArmStat estimated Armenia’s permanent population on January 1, 2024 to be at 2.99 million, up by more than 53,000 from a year earlier, driven largely by the complete and forced displacement of more than 100,000 Artsakh Armenians into Armenia in September and October. Authorities have reported that by mid-December, 6,636 Karabakh Armenians had left the country. The number actually decreased to 6,433 by mid-January despite worries of emigration among Artsakh refugees.

2023 saw continued recovery of the natural growth rate after the devastating effects of the Covid pandemic and the 2020 war in Nagorno-Karabakh. In 2020, the combined fatalities of war and Covid prompted a negative growth that year as deaths exceeded births for the first time in decades (likely since World War II).

Since 2019, the birth rate in Armenia has been relatively consistent, standing between 12.2 to 12.4, while the death rate has fluctuated from the high of 12.3 in 2020, to below 9 in 2019 and again in 2023.

Despite the overall growth in population (largely due to the influx of Karabakh Armenians), 2023 saw negative net migration, based on the difference of arrivals and departures, of 29,494, compared to a positive net of 38,732 the preceding year. Most travel to and out of Armenia occurs through Yerevan’s Zvartnots airport, followed by the Bagratashen and Bavra crossings on the Georgian border, and the Meghri crossing on the border with Iran. Notably, for the first time in decades, a small number of people crossed the Armenia-Turkey border as the Margara checkpoint was temporarily opened in February 2023 so that Armenia could deliver humanitarian aid to the earthquake victims.

A total of 8,761 foreigners were granted (permanent and temporary) residence permits by Armenia in 2023, including 3,350 citizens of Russia, 2,035 Indians, and 766 Iranians.

Tourism

In 2023 Armenia’s tourists stood at 2.3 million, thus surpassing the pre-Covid record high of 1.9 million in 2019. It represents a 40% growth compared to 2022, when the figure stood at 1.7 million. Half of all tourists came from Russia, followed by neighbors Georgia at 11%, Iran at 6%, the U.S. (3%), and India (1.5%).

And ending on a lighter note, the most common names given to baby girls and boys did not change from the previous year. They are Nare, Arpi, Maria and Davit (David), Narek, Hayk, respectively.

Also see

Regional (Dis)Connectivity: Armenia’s Trade With Neighbors

Armenia trades with three of its four neighboring countries, except Azerbaijan. Land borders with Georgia and Iran serve as crucial lifelines for Armenia, connecting the landlocked country to the global market.

Read moreEconomy

Part 1

Part 2

Part 3

The Pitfalls of Deregulation and Competition in Armenia’s Electricity Market

Will the introduction of competition in the retail electricity market benefit consumers or will deregulation lead to market manipulation, price increases and potentially harmful conditions, especially for residential customers? Economist Ara Khanjian explains.

Read moreWomen and the Economy: The Intellectual Capital of Armenia

While the social implications of gender imbalance are often discussed in terms of gender equality, it is important to also consider the significant economic consequences of under-leveraging 52% of the educated potential workforce and the loss of human capital productivity.

Read more