Armenia trades with three of its four neighbors, including Turkey, the border with which is sealed. Armenia and Azerbaijan, engulfed in an interstate conflict, do not trade. Armenia’s land borders with Georgia and Iran are open and additionally serve as lifelines for the landlocked country to the outside world. This is well understood in Yerevan. Prime Minister Nikol Pashinyan recently called Georgia “fraternal” and Iran a “friendly” country for Armenia.

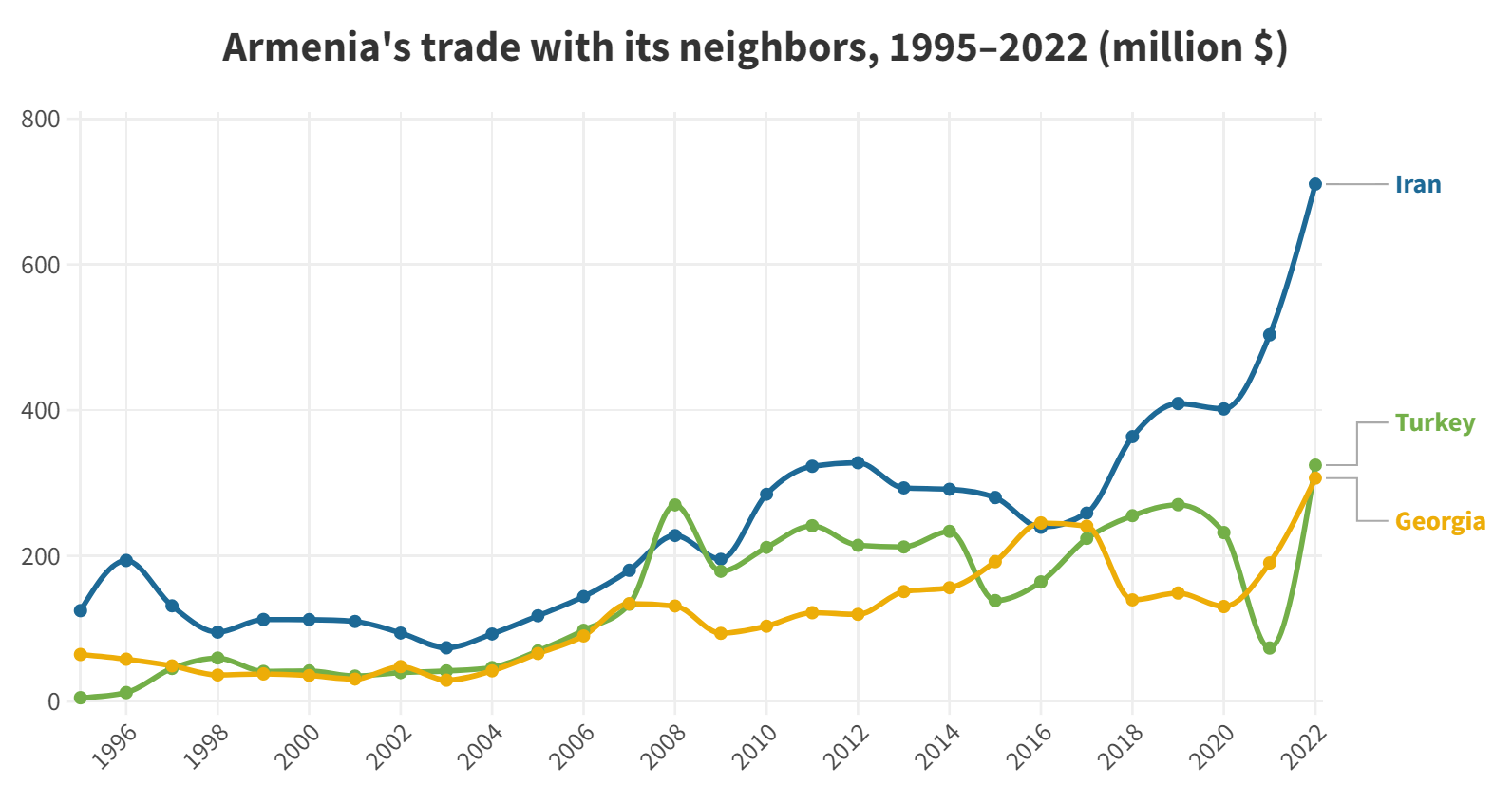

Last year, Iran, Turkey and Georgia were among Armenia’s top 10 trading partner countries. Trade with Iran in 2022 stood at $710 million, making that country Armenia’s fourth largest partner after Russia (over $5 billion), the EU ($2.3 billion), and China ($1.75 billion). Trade with Turkey and Georgia stood nearly two-times lower, at $325 and $307 million, respectively.

Collectively, trade with its three neighbors comprised 9.5% of Armenia’s international trade. For as long as data is available (since 1995), Iran has consistently been a largest partner among the neighbors, except for two years.

Iran

Armenia has traditionally maintained cordial diplomatic relations with Iran since gaining independence. Geographically, the two countries share a border, but they are physically separated by the Araks (Aras) River. A pontoon bridge was initially constructed in May 1992 and was replaced with a permanent one by late December 1995. This bridge remains the sole road connection between the countries. As trade continues to expand, officials from both nations have recently announced that building a second bridge over the Araks River is on the table. There have long been plans to build a railway connecting the two countries, but those plans seem to have been permanently shelved.

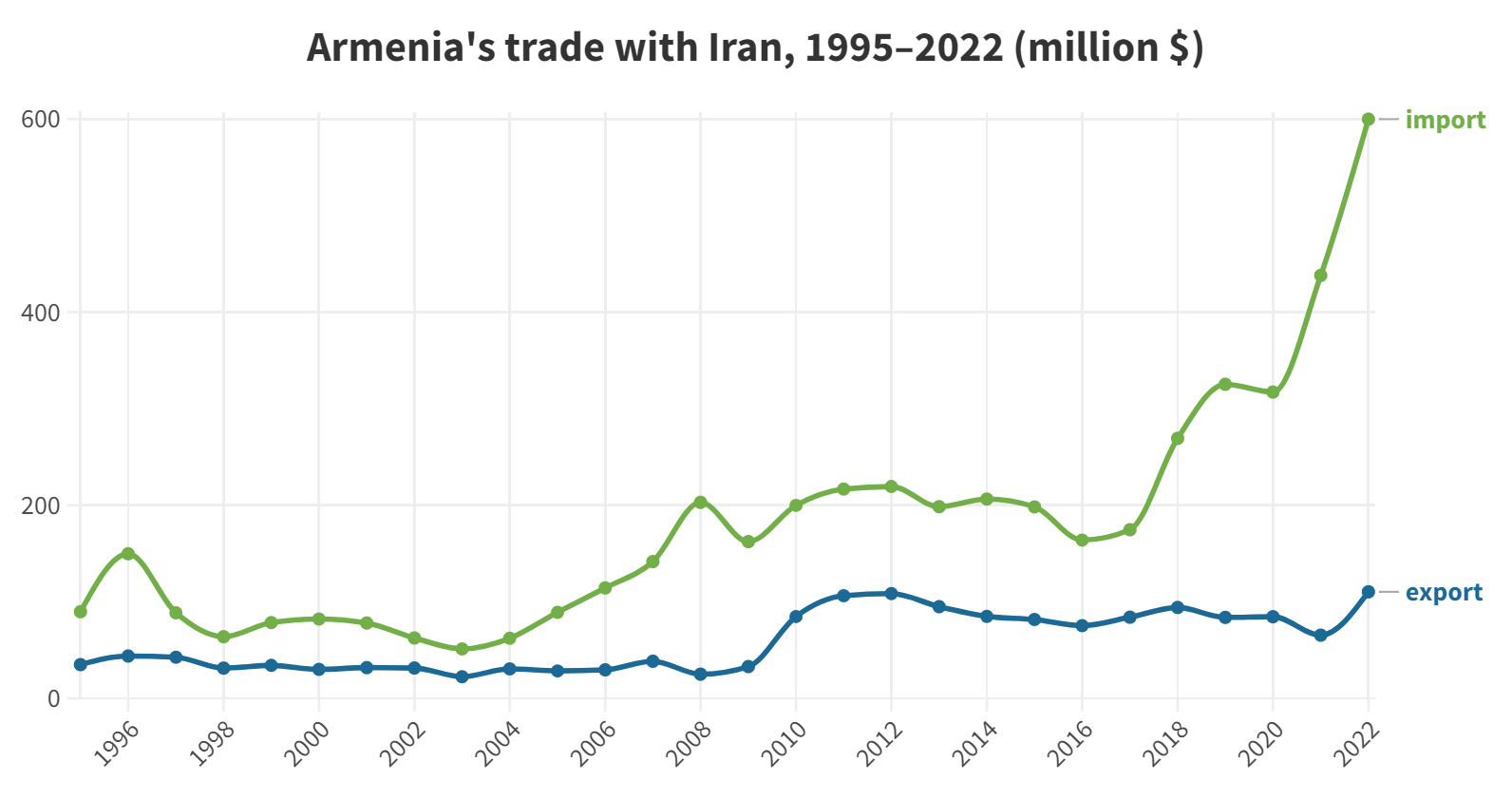

In total, over almost three decades, Armenia has imported three times more from Iran than it has exported to Iran. Since data became available in 1995 until September 2023, Armenia-Iran trade stands at $7.2 billion, comprising $1.7 billion in Armenian exports to Iran and $5.5 billion in Iranian imports to Armenia. Imports from Iran have consistently surpassed Armenian exports every year.

Recent years have seen a drastic increase in Armenia-Iran trade. It nearly doubled in just four years, from around $360 million in 2018 to $710 million in 2022, almost entirely due to the rise in Iranian imports to Armenia. Iran and the Eurasian Economic Union, where Armenia is a member, are expected to sign a free trade agreement in late December, which will further boost bilateral trade and make Armenia a transit for trade between Russia and Iran.

Last year, in 2022, Armenia exported $110 million worth of goods to Iran, with electricity accounting for almost 60% and tobacco and cigarettes comprising nearly 22%.

Armenia’s imports from Iran are far more diverse. Last year, natural gas, oil and oil products constituted 26.5% of Iranian imports, with iron and steel products following closely at nearly 23%. But Armenia also imported a significant amount of vegetable and dairy products, plastics, chemicals and cement. In 2019, the import of cement from Iran was restricted through a customs duty to protect domestic production. It has resulted in a significant decline since then.

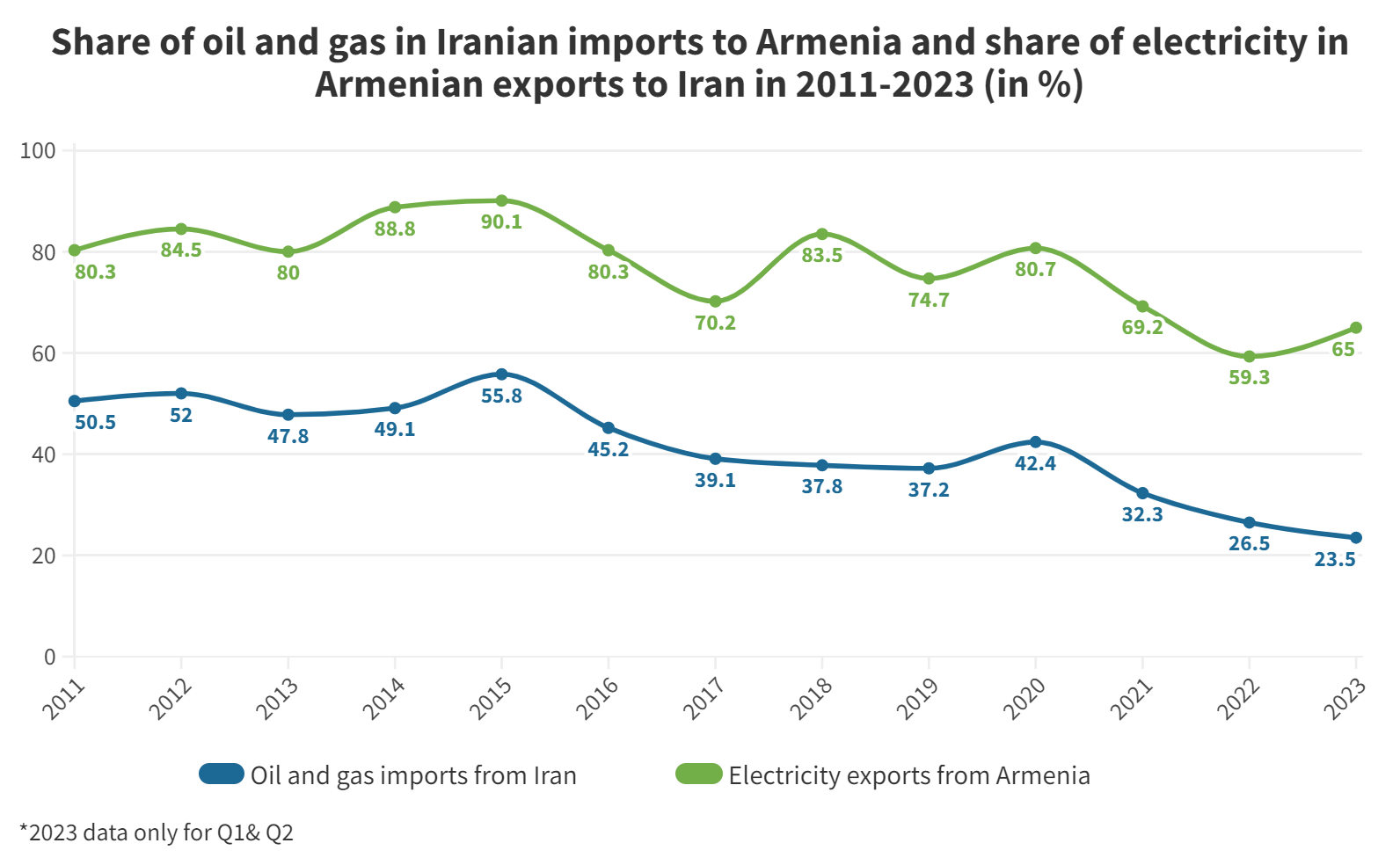

Armenia and Iran enacted an electricity-for-gas deal in 2009, following the completion of a gas pipeline, under which Armenia exports 3 kWh for one cubic meter of Iranian gas. In November 2022, the two countries agreed to double the import of Iranian gas, which has stood at 370 million cubic meters annually in recent years.

Overall, there is a downward trend in the share of oil and gas (and related products) in Iranian imports to Armenia. It has decreased from more than half of all Iranian imports a decade ago to around a quarter in 2022. The share of electricity in Armenian exports to Iran remains dominant, but has also dropped somewhat, from between 80% and 90% less than a decade ago, to between 60% and 70% in recent years.

Turkey

Armenia shares a much longer land border with Turkey, but as with Iran, most of it is formed by the Akhuryan and Araks rivers. There are three existing bridges connecting the two countries. One near the village of Margara connects Yerevan (via Ejmiatsin) with Igdir, while the other two, including a railway bridge, are near Akhurik and connect Gyumri with Kars. Turkey permanently sealed the border in 1993 after Armenian forces captured Kelbajar during the first Nagorno-Karabakh War. For this reason, most bilateral trade is conducted through Georgia.

As part of the ongoing normalization efforts, both countries agreed in July 2022 to open the land crossings for diplomats and citizens of third countries. In February 2023, the Margara bridge saw its first use in three decades when Turkey allowed the passage of Armenian trucks, which were delivering humanitarian aid to the victims of the earthquake in the Gaziantep area. As of early December 2023, the Armenian government has nearly completed refurbishing the Margara checkpoint, pending partial opening, which may or may not happen next year.

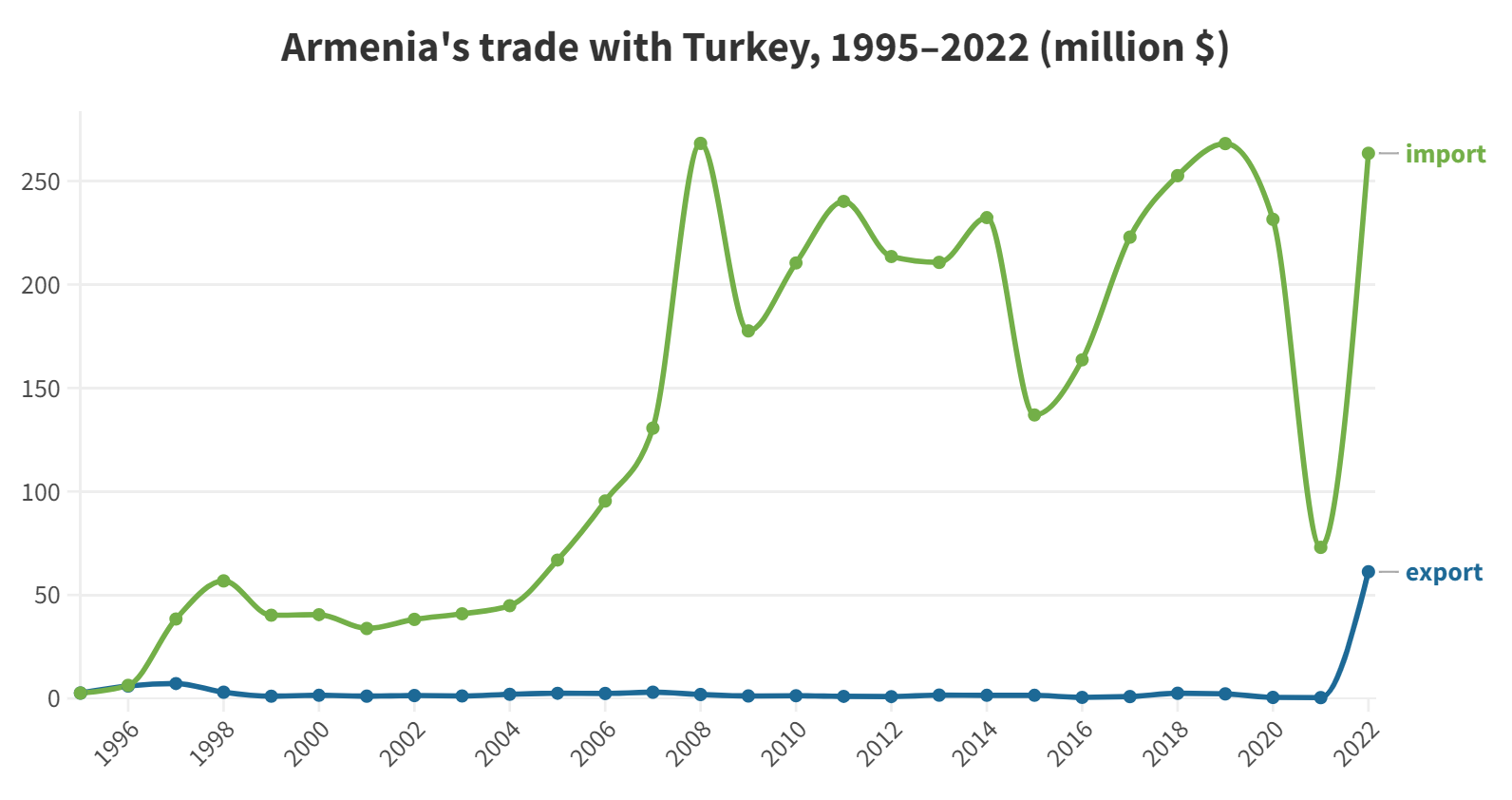

In the early post-Soviet period, Armenia’s trade with Turkey remained modest, mostly below $50 million annually, until 2004. It then skyrocketed to reach almost $270 million by 2008. It fluctuated greatly in the subsequent decade, matching the 2008 peak only in 2019.

In late 2020, in response to the Turkish intervention in the war in Nagorno-Karabakh (Artsakh), including through mercenaries, the Armenian government enacted an embargo on Turkish goods, except raw products. This led to a dramatic drop in trade, falling to just $73 million in 2021. After the Armenian government lifted the embargo, trade in 2022 recovered to 2019 levels. The first ten months of 2023 have already seen the highest trade volume ever-recorded between the two countries, at $280 million.

Trade between the two neighbors has always been one-sided. With the exception of 2022, Armenia has never exported any substantial amount of goods to its western neighbor, with the highest annual exports being just $7.2 million, in 1997. In 2022, Armenian exports stood at $61 million, with 95% being unwrought gold, which the exporting company claimed it had imported from Russia and were ultimately delivered to the United Arab Emirates.

Armenia imports a variety of mostly consumer goods from Turkey. Clothing and textiles, perhaps the most visible of Turkish imports, made up 29% of the total in 2022. In fact, more than 16% of total clothing and textiles imports to Armenia came from Turkey last year.

Machinery and electrical equipment stood at 16%, metal products at 11%, followed by chemicals, plastics and rubber, vegetables, wood products, and transport equipment.

Georgia

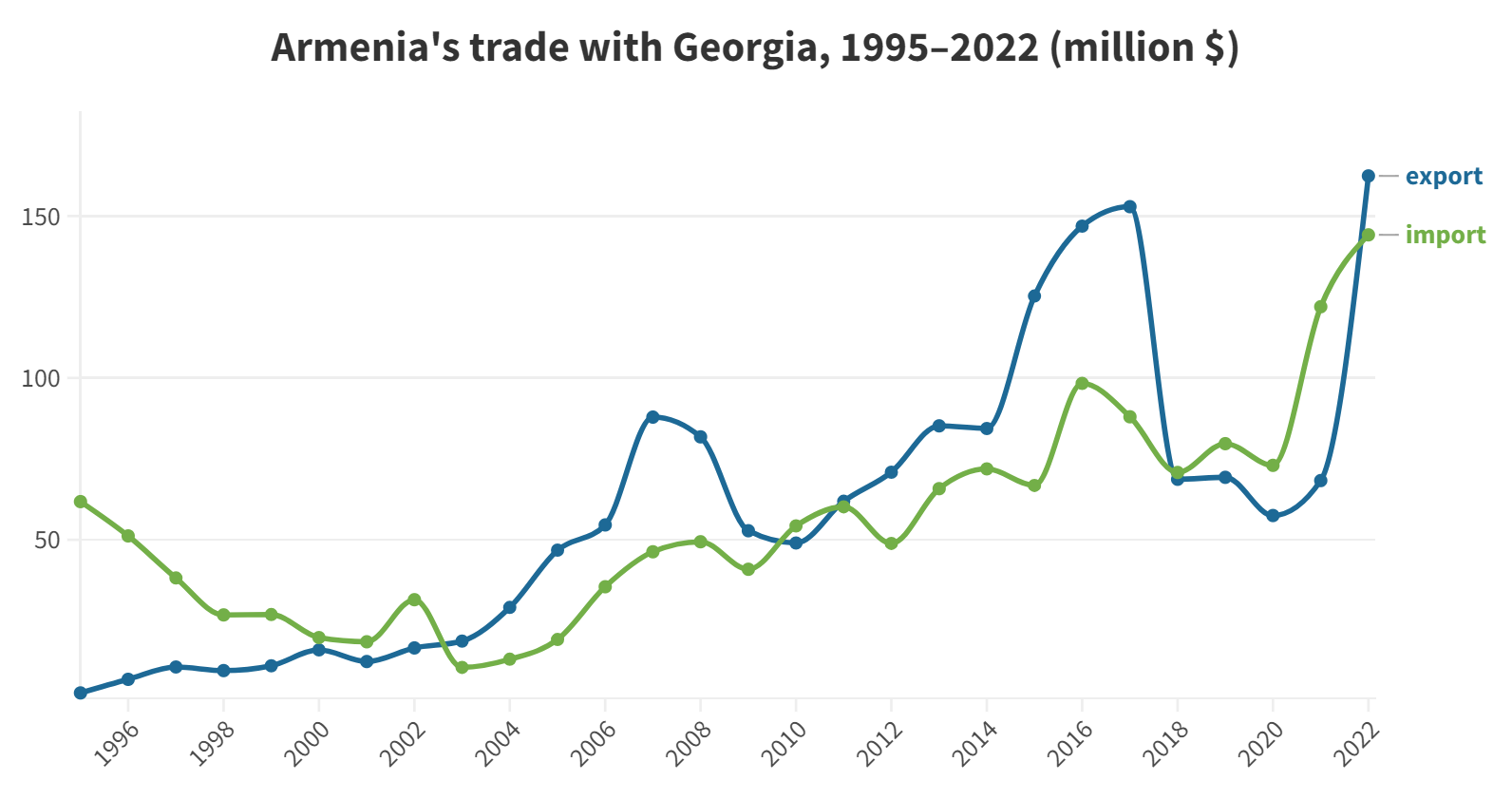

Armenia trades with Georgia, far smaller than either Iran or Turkey, on a more equal footing. Imports from and exports to the northern neighbor have been neck and neck for decades, with Armenian exports usually coming on top. Total trade between the two countries over nearly three decades stands at almost $3.4 billion, with Armenian exports to Georgia at $1.77 billion and Georgian imports to Armenia at $1.62 billion.

Last year, the top Armenian exports to Georgia were fruits and nuts (21%), electricity (17.5%), cigarettes (12%), plastic and glass containers (10%), iron and steel products (9%).

Armenia imported from Georgia foodstuffs, primarily non-alcoholic beverages and animal feed (23%), fertilizers and other chemicals (16%), nuts, citrus fruits, and other vegetable products (15%), iron and steel products (13%).

For Armenia, more vital than direct trade with Georgia is that country’s role as a link to much of the outside world. As much as 80% of Armenia’s trade passes through road crossing points with Georgia. That country serves as the sole connection to its largest trading partners, Russia via the Upper Lars checkpoint, and the European Union via the port of Poti.

Economy

Women and the Economy: The Intellectual Capital of Armenia

While the social implications of gender imbalance are often discussed in terms of gender equality, it is important to also consider the significant economic consequences of under-leveraging 52% of the educated potential workforce and the loss of human capital productivity.

Read moreArmenia’s Economic Dependence on Russia: How Deep Does It Go?

Much has been written about Armenia’s political and security ties, including its dependence and overreliance on Russia. Hovhannes Nazaretyan provides an overview of Russian control and influence in Armenia's economy.

Read moreThe Shifting Real Estate Market

Despite uncertainty stemming from security concerns, Armenia’s real estate market continues to experience growth with record-breaking transactions, and excessive prices, especially in the rental market.

Read moreLaw & Society

The Bread Dilemma: Choosing Between Wheat Imports and Domestic Cultivation

Wheat production and import are critical security issues for Armenia. Lilit Avagyan delves into the measures taken to ensure Armenia's food security, focusing on increasing wheat self-sufficiency and maintaining ongoing wheat imports.

Read moreUnregistered Employment, Lost Taxes, Compromised Rights

In the last three years, the number of reported cases of unregistered workers has increased in Armenia. Despite numerous legislative regulations and monitoring tools, unregistered employment remains a critical issue.

Read moreProposed Changes in Armenia’s Tax System

The Tax Revenue Management Plan for 2022-2025 will encompass several alterations in Armenia’s taxation system. Arpine Simonyan presents the main types of taxes in Armenia, the planned changes and challenges taxpayers face.

Read moreMagazine Issue N28

Manufacturing